In a striking display of enduring market drive, Wall Street’s major indices ascended to commendable heights on Monday, reinforcing the robustness of its seven-week winning streak. The Dow Jones Industrial Average notched a modest gain, while the S&P 500 and Nasdaq Composite showed more significant advances. This upbeat momentum positions the S&P 500 very close to eclipsing its all-time high, a pinnacle last achieved in the early days of 2022. Driven by a mix of investor optimism, catalysed by the Federal Reserve’s dovish interest rate projections and cooling inflationary pressures, the market’s pulse resonated with a newfound vitality. Amidst this financial passion, sectors such as communication services and technology spearheaded the rally, while landmark corporate movements, notably U.S. Steel’s surge following its acquisition news, painted a tableau of a market in dynamic flux yet poised for potential growth.

Key Takeaways:

- S&P 500 Nears Historical Highs: Demonstrating remarkable resilience, the S&P 500 index climbed 0.57%, positioning itself a mere 1% below its all-time closing peak of 4,796.56, achieved in January 2022.

- Nasdaq Composite’s Robust Advance: The Nasdaq Composite outperformed with a 0.77% rise, showcasing the tech sector’s significant influence and investor confidence in technology-driven growth.

- Dow Jones Inches Upward: The Dow Jones Industrial Average marked a subtle yet noteworthy ascent, adding 15 points, translating to a 0.04% increase. This uptick contributes to a broader narrative of sustained market growth.

- Communication Services Sector Soars: Within the S&P 500, the communication services sector emerged as a standout, registering an impressive gain exceeding 2%. This surge was significantly propelled by major players like Meta Platforms, which escalated over 3%, and Alphabet, which leaped more than 2%.

- U.S. Steel Shares Skyrocket: Triggered by the announcement of its acquisition by Japan’s Nippon Steel for a staggering $14.9 billion, U.S. Steel’s stock experienced a meteoric rise of 26%, signalling robust market reaction to strategic corporate manoeuvres.

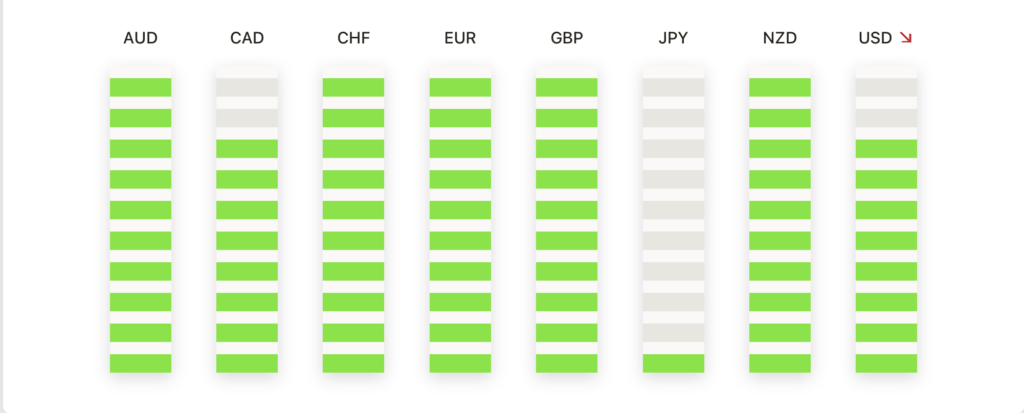

FX Today:

- EUR/JPY Gains Amid Risk-On Sentiment: The EUR/JPY pair advanced, trading at 156.02, up 0.77%, after recovering from a daily low of 154.74. This movement is in anticipation of the Bank of Japan’s upcoming monetary policy decision, reflecting a positive market outlook.

- Canadian Dollar Slightly Retracts Ahead of CPI Data: The Canadian Dollar experienced a minor pullback, trading around 1.3400 against the U.S. Dollar. This retraction is seen as the market braces for the release of the Canadian Consumer Price Index, a key economic indicator.

- USD/JPY Shows Fluctuations: The USD/JPY pair demonstrated slight fluctuations, maintaining stability above the 145.50 level. The pair’s performance indicates market reactions to global economic and monetary policy developments.

- Dollar Index (DXY) Experiences Minor Downturn: The Dollar Index witnessed a small decline of 0.05%, reflecting a nuanced response in the dollar’s valuation amid evolving market conditions and the Federal Reserve’s interest rate projections.

- Gold Prices Show Mixed Responses: Gold prices saw a mixed performance, with February gold (GCG4) marginally up by 0.04%, and March silver (SIH24) down by 0.20%. Gold’s slight uptick, supported by a weaker dollar and more conservative Fed projections, contrasts with higher global bond yields and hawkish central bank comments, influencing its short-term market dynamics.

Market Movers:

- Align Technology Rises on FDA Clearance: Align Technology (ALGN) saw its shares climb over 3% following the U.S. Food and Drug Administration’s (FDA) approval for its Invisalign palatal expander system.

- U.S. Steel Surges on Acquisition News: United States Steel Corporation (X) witnessed a remarkable surge of more than 25%.

- Netflix Gains on Raised Price Target: Netflix (NFLX) shares were up more than 3%, leading the gains in the Nasdaq 100.

- Energy Sector Climbs with WTI Crude Price: The energy sector experienced significant growth, with companies like Baker Hughes (BKR), ConocoPhillips (COP), and others climbing more than 2%.

- Adobe Appreciates After Terminating Merger Deal: Adobe (ADBE) saw its shares increase by more than 2% after announcing the termination of its $20 billion merger agreement with Figma Inc.

- Merck & Co Leads Dow Jones Gains: In the Dow Jones Industrials, Merck & Co (MRK) emerged as a top gainer, with its shares up more than 1%.

- Costco Wholesale Elevates on Raised Target: Shares of Costco Wholesale (COST) increased more than 1% after HSBC elevated its price target on the stock from $600 to $700.

- VF Corp Drops Amid IT System Disruption: VF Corp (VFC) experienced a significant decline, leading the losers in the S&P 500 with a drop of more than 8%.

- Roku Downgraded, Shares Decline: Roku (ROKU) saw its shares fall by more than 1% following a downgrade by Seaport Global Securities.

Conclusion:

In a day marked by robust advances, Wall Street’s narrative was one of resilience and cautious optimism, underscored by the S&P 500 and Nasdaq nearing record heights amid Federal Reserve rate cut expectations. This resilience, however, is set against a backdrop of complex challenges, from geopolitical tensions impacting oil markets to patent disputes in the tech sector. As investors navigate this multifaceted landscape, the market’s response to these diverse forces not only reflects current sentiment but also sets the stage for future financial trends, balancing the dynamics between immediate reactions and long-term strategic positioning.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.