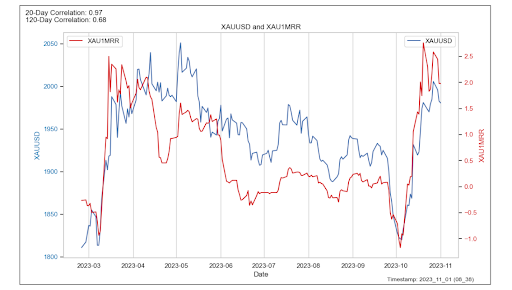

Gold is currently at a critical support level, with XAUDUSD attempting to break below the 1980 level. The recent decline in both gold and oil prices suggests a gradual unwinding of the risk premium associated with geopolitical tensions. Additionally, XAUUSD 1-month risk reversals, depicted in red, have not reached new highs, indicating some equilibrium in the options market. Coupled with the rise in real yields, this exerts pressure on gold. If today’s US data is robust, it could trigger a mean reversion lower for the precious metal.

Despite a notable decrease in the VIX, equities have exhibited soft trading. This lackluster performance can be attributed to the US 10-Year Treasury Yield surpassing 4.9% overnight. To spur a recovery, equities would require both the VIX and US 10-Year Treasury Yield to decline.

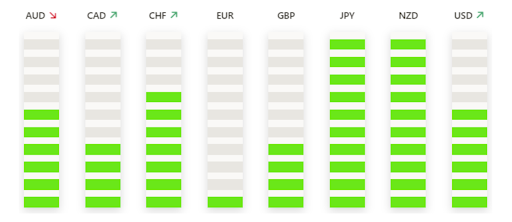

The Dollar Index (DXY) has retained most of its gains from yesterday, which were initially attributed to month-end related flows. However, the lack of a pullback after the London Fix suggests that some upside momentum may be related to pre-positioning ahead of today’s significant risk events.

In Today’s FX Markets

The Euro (EUR) is leading the major currencies in a downward trajectory, mainly due to the strength of the US Dollar. The Japanese Yen (JPY) is the strongest performer following a response from Japanese officials regarding the JPY’s recent weakness.

Several key risk events are on the agenda for today:

- ADP Employment Report: While worth monitoring, this data point is considered the least significant for the day, given the market’s recent lack of reaction.

- ISM Manufacturing Purchasing Managers’ Index (PMI) & JOLTS Job Openings: These two reports are released concurrently. For an optimal trade outcome, both data points, including the ISM sub-components, would need to show a significant deviation outside the market’s expectations. Given the proximity to the FOMC meeting, substantial deviations are required to excite the markets for trading these events.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.