Risk assets tumbled last night as geopolitical tensions saw more escalations. Talks of attacks on US Navy ships sent geopolitical jitters across markets boosting gold and oil prices. The DXY continues to trade surprisingly uncorrelated to yields or geopolitical risks.

Fed Chair Powell’s speech

Last night’s speech by Fed Chair Powell didn’t provide markets with any fireworks and saw mostly two-way price action for risk assets. However, during the talks there were news that the US Navy shot down missiles that were fired at them in the middle east, which gave risk assets a push lower.

Equity markets

Equity indexes like the S&P broke below key trend support on the news, which also saw the VIX trading to its highest levels since March. With yields close to their recent highs and the VIX breaking out, the short-term bias for equities remains negative with the short-term headwinds stronger than med-term tailwinds.

DXY

The one asset that continues to surprise is the DXY which continues to trade uncorrelated to the recent move in yields as well as the geopolitical situation. Usually, upside in yields is supportive of the USD, as well as safe haven inflows with negative geopolitical shocks. However, the DXY has traded mostly rangebound.

Sterling

Sterling got a push lower earlier in the session on the back of the much worse than expected Retail Sales data. Even though the miss helped EURGBP break higher and trade above key resistance at 0.87, the current price and yields spread divergence gives us reason to be patient.

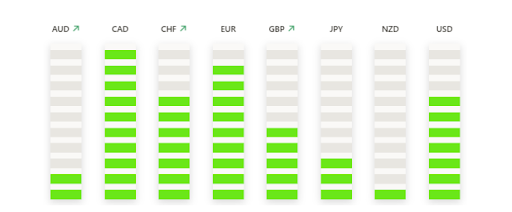

Currency markets

In FX the CAD is leading the major currencies to the upside in which seems to be mostly driven by the recent move in oil, but the correlation has been spurious of late. The NZD is the weakest of the majors which looks more risk sentiment driven with the AUD the second weakest currency on the session as well.

Calendar

The calendar is exceptionally light this afternoon with no major risk events to keep on the radar.

Outlook

That means that the bulk of the market’s focus will come from the current geopolitical environment. Any major escalations in the conflict are expected to see further upside in gold and oil, as well as possible short-term pressure in equities. Where any major de-escalations could see the opposite price action with gold and oil buyers taking profit and a potential reduction in equity volatility which could send equities higher.

It’s also worth keeping in mind that even if we don’t see a meaningful de-escalation, that markets tend to discount geopolitical risks fairly quickly. Take gold with the Russia invasion last year, had a 10% rally in 9 days and took 6 to unwind about 90% of the move.

It’s important to be aware if things escalate meaningfully, markets can move further, and with things like gold the trend and momentum chasers are all over it which can push it further. But just worth realising that these negative geopolitical flows usually fizzle out.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.