With US markets closed for Presidents Day, global financial markets showed mixed results on Monday. European stocks edged higher, building on the positive momentum from last week, despite the lack of US trading activity. The European Stoxx 600 index made modest gains after a slow start, led by healthcare stocks, while mining stocks fell. In this mixed environment, Swiss software company Temenos notably surged, bouncing back from recent losses after a negative report by Hindenburg Research. Meanwhile, in the Asia-Pacific region, China’s markets increased due to strong holiday travel data, but Hong Kong’s stocks dropped. The day’s trading highlights the importance of regional news, corporate updates, and speculation on future Federal Reserve actions, presenting a challenging landscape for investors.

Key Takeaways:

- European Markets Show Resilience: The Stoxx 600 index closed up by 0.17%, demonstrating a slight rebound among varying sector performances. Healthcare stocks emerged as frontrunners with a 0.95% gain, while mining stocks lagged, recording a 1% decline.

- Asia-Pacific Markets Display Mixed Outcomes: China’s markets welcomed traders back from the Lunar New Year holidays with a 0.5% rise in the CSI 300 index, carried by a 1.2% increase in tourism stocks. Conversely, Hong Kong’s Hang Seng index fell by 1%, with the tech sector experiencing a notable 2.7% drop, illustrating the divergent impacts of regional economic data and policy expectations.

- Emerging Market Currencies and Interest Rate Speculations: The steady stance of the People’s Bank of China, holding a key policy rate at 2.5% compared with anticipations of the Federal Reserve’s policy direction, sets a complex stage for currency markets and future interest rate expectations, influencing investment flows and currency valuations.

- Travel and Tourism Stocks in China Rally: Positive holiday travel data propelled a 2.1% jump in China’s travel stocks index, with notable gains in major airlines and tourism companies. This is reflective of a resurgence in consumer spending and mobility above pre-pandemic levels, highlighting the sector’s recovery and its impact on related stock performances.

- Temenos Shares Experience a Turnaround: Following a turbulent previous week, shares of Temenos surged by 8.8%, a significant recovery attributed to market reactions against a negative report, showcasing the volatility and rapid shifts in investor sentiment within the tech sector.

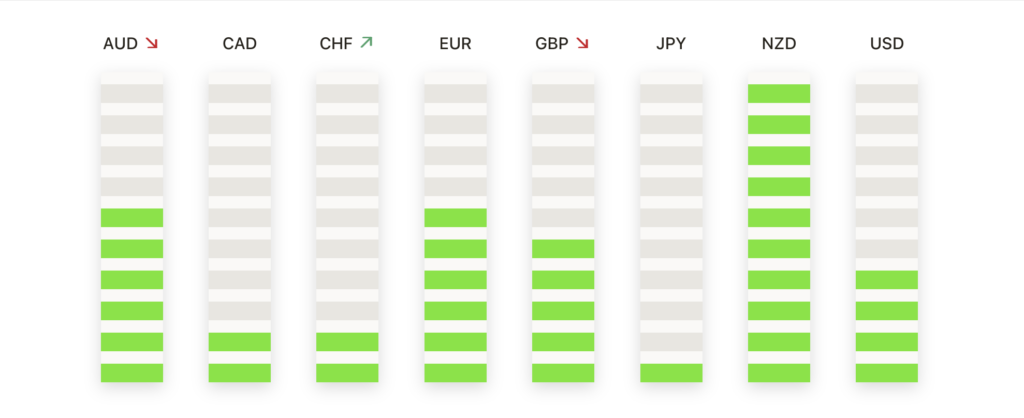

FX Today:

- EUR/USD Stalls Below Key Threshold: The EUR/USD pair saw minimal movement, ending the session just shy of the 1.0800 mark at 1.0795. Encountering resistance at the 200-hour Simple Moving Average (SMA) situated at 1.0760, the pair struggled to gain momentum, with immediate ceilings at 1.0805 and 1.0820 acting as barriers to upward movement.

- GBP/USD Experiences Slight Decline: On a day marked by quiet activity, the GBP/USD pair recorded a marginal loss, closing at 1.2597, down from an opening of 1.2605. With volatility at a low, the currency pair’s movements were tightly bound, facing resistance at 1.2620 and support at 1.2580. Market anticipation for future monetary policy adjustments by the Bank of England and the U.S. Federal Reserve remains high, as traders look for signals that could sway the pair’s direction.

- AUD/USD Awaits RBA’s Next Move: The Australian dollar remained resilient, trading near 0.6548, just below the significant level of 0.6550. Investors are on edge as they await the Reserve Bank of Australia’s (RBA) upcoming policy announcement, which could dramatically influence the AUD/USD’s path. Additionally, Australia’s PMI figures for February are anticipated to shed light on the nation’s economic health, potentially affecting the pair’s movement in the near term.

- USD/JPY Holds Steady Amid Economic Uncertainties: The USD/JPY pair kept its ground, trading around the 150.00 mark, as it tackled Japan’s recessionary pressures and the looming possibility of interest rate decisions by the Bank of Japan. With the pair oscillating between support at 149.85 and resistance at 150.20, the complex dynamics of Japan’s economic indicators and the anticipation of US Federal Reserve’s policy shifts play a crucial role in shaping the yen’s value.

- Gold Prices Respond to Economic Signals: Gold prices experienced a notable increase, with spot gold closing at $1,945 per ounce, up from the day’s low of $1,935. Resistance for gold prices is observed at the $1,950 mark, with further upside potential towards $1,960 if economic uncertainties persist. The anticipation of rate adjustments and their impact on currency strength continues to be a significant factor influencing gold’s appeal as a safe-haven asset.

Market Movers:

- AstraZeneca Advances on Lung Cancer Drug Developments: AstraZeneca’s stock appreciated by 3% in afternoon trading, following the announcement of positive developments in lung cancer treatments. The company’s leading cancer drug, Tagrisso, demonstrated “overwhelming efficacy” in a recent trial, along with gaining U.S. FDA approval for a specific lung cancer treatment, underscoring the pharmaceutical giant’s strategic success in oncology.

- Currys Enjoys a Rally on Takeover Speculation: Shares in UK-based retailer Currys soared by 36.4% as news broke of potential interest from China’s JD.com in evaluating a takeover bid. This interest sparked a significant stock price increase, indicating market optimism around the potential deal and reflecting the impact of merger and acquisition activity on stock valuations.

- Santander Gains on Dividend and Buyback News: Spanish banking giant Santander saw its stock increase by 1.8% following the announcement of a new share buyback program and an enhanced dividend. This positive market reaction showcases the appeal of shareholder return strategies in bolstering investor sentiment and stock performance.

- Forvia Faces Downward Pressure Amid Job Cut Announcements: The automotive supplier Forvia saw its shares slump by 12.7%, reversing early gains following the announcement of plans to cut up to 10,000 jobs in Europe over the next five years. The market’s reaction to this news underscores the challenges facing the automotive industry and the investor concerns over future profitability and growth.

- Nintendo Experiences a Dip on Switch 2 Launch Delay Rumours: Shares of Nintendo fell more than 6% amid unconfirmed reports suggesting a delay in the launch of its next console, potentially pushing the release to early next year. This decline reflects the sensitivity of stock prices to product launch timelines and market expectations for major tech and entertainment companies.

As the trading day comes to a close, the balance between restrained optimism and complex market trends becomes clear across the global financial scene. European markets saw slight gains despite the US markets being closed, while signals from the Asia-Pacific region were mixed. Investors are navigating through a dense landscape of economic data, corporate announcements, and market predictions. The key market influencers included tech companies recovering from negative analyses and notable fluctuations in commodity markets, illustrating the constant market volatility and the necessity for strategic foresight. Against this backdrop, the expectation of decisions from central banks and global political events continues to drive investor sentiment, highlighting the need for vigilance and flexibility in the interconnected global market environment.