The global financial markets experienced a day of mixed dynamics as U.S. traders took a break for Thanksgiving, creating a unique scenario where European and Asian markets took the forefront. European stocks and the Euro showed notable resilience in this altered trading environment, while volatility was evident in the oil markets due to the latest developments from OPEC+. This scenario provided a glimpse into the market’s behaviour in the absence of one of its biggest players, offering insights into regional strengths and vulnerabilities.

Key Takeaways:

- European Bond Market Dynamics: Germany’s 10-year bund rose about 5 bps to 2.62%, a decrease from its 3% level last month. In the U.S., ten-year Treasuries stood at 4.4%, down from their October peak of 5%.

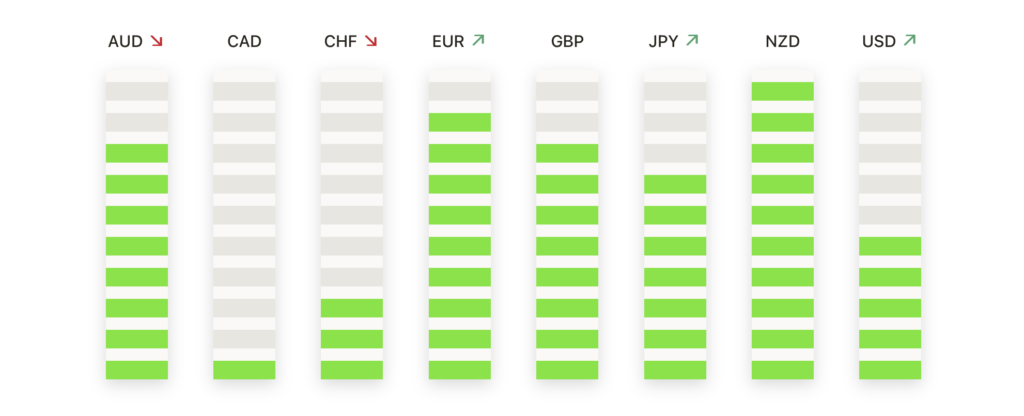

- Currency Fluctuations: The Euro’s rise led to the dollar index approaching a 2 month low, a reversal from Wednesday’s trend following an unexpected drop in U.S. unemployment claims.

- Oil Market Reactions to OPEC+: Brent and U.S. WTI crude oil prices dropped to $80.70 and $76.03 per barrel, respectively, a 2% decline prompted by the delayed OPEC+ meeting and speculation about future production cuts.

FX Today:

- Euro’s Strengthening: The Euro benefited from positive PMI data, reflecting economic resilience despite broader challenges.

- Sterling’s Performance: The UK’s Sterling advanced, reaching $1.2555 against the dollar, its highest since early September, boosted by the UK private sector’s fastest growth in four months.

- USD/CHF Pair Dynamics: The USD/CHF pair experienced significant fluctuations, reflecting market uncertainty, with key levels at 0.8750 and 0.9000 indicating its struggle for a consistent direction.

- EUR/GBP Analysis: The EUR/GBP pair grappled for stability, hovering around the 0.8700 mark, influenced by the ECB’s dovish stance and mixed PMI data.

- CAD/USD Trading Flat: The Canadian Dollar (CAD) showed a lack of momentum, trading near the opening bids of 1.3700 against the US Dollar (USD). The USD/CAD pair briefly dipped to a weekly low of 1.3650 but was pulled back to 1.3700, influenced by slight shifts in Crude Oil prices.

Technical Analysis:

- Currency Pair Trends: Detailed technical analysis suggests a cautious trading environment for major currency pairs, with critical resistance and support levels guiding market behaviour.

- Gold Price Analysis: Gold’s technical resistance is identified at $2010.00, with support at $1985.00 and further stability provided by the 200-day SMA at $1937.00.

- Canadian Dollar Technical Analysis: The USD/CAD is currently constrained by the 50-hour and 200-hour SMAs, with key support levels at 1.3670 and 1.3512. Technical indicators like the RSI and MACD suggest a neutral stance, indicating a lack of clear directional strength.

In summary, while U.S. markets observed the Thanksgiving holiday, global financial markets remained active. European bonds and the Euro showed strength, oil prices reacted to OPEC+ decisions, and major currencies like Sterling and the Euro navigated through economic data releases. Investors should closely monitor these developments, particularly in light of impending economic data releases.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.