Major Headlines for September 15, 2023

- EUR remains on the backfoot after yesterday’s dovish ECB policy decision. The European Central Bank (ECB) raised interest rates yesterday, but also signaled that they have reached a “sufficiently restrictive” level of rates. This sent the EUR lower across the board.

- Aussie & NZD lifted as Chinese data surprises to the upside. The Australian dollar (AUD) and New Zealand dollar (NZD) were lifted today by better-than-expected economic data from China. Retail sales, industrial production, and employment all came in higher than expected, suggesting that the Chinese economy is still growing at a healthy pace.

- Commodities & Equities rally on various factors (dovish ECB, China RRR cut, better Chinese data, Arm IPO). Commodity prices and stock markets rallied today on a number of factors, including the dovish ECB decision, a surprise rate cut by the People’s Bank of China (PBoC), and better-than-expected Chinese data. The Arm IPO was also a positive factor for sentiment.

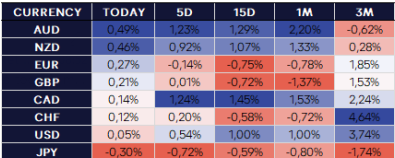

FX Strength Matrix

- AUD leading the major currencies to the upside. The AUD is the strongest of the major currencies today, following the PBoC rate cut and the better Chinese data.

- JPY the weakest of the majors. The JPY is the weakest of the majors today, as the Bank of Japan (BoJ) reiterated its commitment to easy monetary policy.

US Consumer Sentiment data to be released later today. The only major economic data release scheduled for today is the US University of Michigan Consumer Sentiment data. This report is not a major market mover, but it will be closely watched for any signs of change in consumer sentiment for a couple of reasons.

Firstly, as consumer spending makes up roughly 70%-80% of US GDP, the state of the consumer matters. Secondly, the inflation expectations components of the report have been a source of volatility over the past few months given the market’s focus on inflation.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.