As the global economic landscape contends with rising uncertainties, recent economic downturns in the UK and Japan raise fears of recession, shaking the stability of worldwide markets. The UK has entered a technical recession after its economy shrank in the last quarter of 2023, showing how fragile its recovery is. Japan also fell into a recession and was surpassed by Germany as the world’s third-largest economy, marking a difficult start to the year and revealing weaknesses in its economy. In contrast, the US stock market is doing well, with the S&P 500 hitting a new record high, showing a significant difference compared to the economic difficulties in the UK and Japan. This contrast not only shows how global challenges are affecting countries differently but also suggests a complicated journey towards recovery and dealing with the threat of more recessions.

Key Takeaways:

- UK’s Economic Contraction Triggers Recession Concerns: The UK economy experienced a decline of 0.3% in Q4 2023, following a -0.1% contraction in Q3, officially marking a technical recession. This back-to-back quarterly shrinkage underlines growing economic vulnerabilities, with the entire year’s GDP barely growing by 0.1% compared to 2022. The multifaceted downturn across services (-0.2%), production (-1%), and construction (-1.3%) sectors further worsens the recession narrative.

- Japan Enters Recession, Loses Economic Standing: Japan’s GDP fell by an annualised 0.4% in the last quarter of 2023, confusing expectations for a 1.4% rise and following a 3.3% contraction in Q3. This unexpected recessionary phase not only underscores the country’s domestic challenges, including sluggish consumption and capital expenditure, but also results in Japan conceding its position as the world’s third-largest economy to Germany.

- US Market’s Defiance Amid Economic Uncertainty: Despite a backdrop of global economic strain, the US markets demonstrated remarkable resilience. The S&P 500 surged to a record high of 5,029.73, up 0.58%, while the Dow Jones Industrial Average increased by 348.85 points (0.91%) to 38,773.12. This contrast in fortunes highlights the US market’s capacity to navigate through mixed economic signals, bolstered by key performers like Tesla and Meta Platforms, which saw substantial gains of 6% and 2%, respectively.

- European Stocks Make Gains Amidst Global Challenges: European markets closed higher, with the Stoxx 600 index climbing by 0.6%, driven by a positive response to corporate earnings and the hefty dividend announcement from France’s Renault, which soared by 6.3%. This uplift in the European stock market, despite the looming recession in the UK and economic shifts globally, indicates an investor optimism in the region.

- Asia-Pacific Markets Show Mixed Responses: The Nikkei 225 index rallied by 1.21% to close at 38,157.94, marking its first close above the 38,000 threshold since 1990, despite Japan’s recessionary status. Conversely, South Korea’s Kospi index slightly declined by 0.08%, showcasing the varied market reactions across the Asia-Pacific region to the global economic developments.

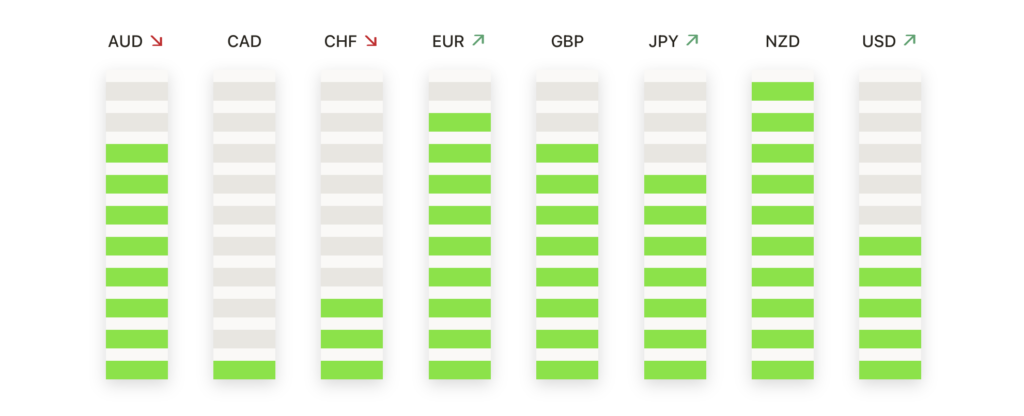

FX Today:

- EUR/USD Demonstrates Strong Recovery Amid Policy Revisions: The EUR/USD pair showcased remarkable resilience, advancing from a low of 1.0700 to peak at 1.0785, a shift propelled by the European Commission’s downward revision of economic growth forecasts and a notable contraction in US retail sales, which recorded a -0.8% decline against an expected -0.3%, weakening the US dollar. This rebound reflects the forex market’s sensitivity to transatlantic economic policy and data revisions.

- USD/JPY Responds to Japan’s Economic Downturn: With Japan officially entering a recession, the USD/JPY pair retreated from its annual peak, closing at 149.95, down 0.42%. This move followed Japan’s GDP report, which showed a surprising annualised contraction of 0.4% in Q4, sparking debates over the Bank of Japan’s continued ultra-loose monetary policy stance and its impact on the yen.

- CAD Strengthens Against the USD on Economic Data and Oil Price Surge: The Canadian Dollar capitalized on weaker US retail performance, with the USD/CAD pair hitting an intraday trough of 1.3475. Concurrently, Brent crude oil prices experienced a 1.5% increase, settling at $82.86 a barrel, which played a significant role in boosting the CAD, reflecting the currency’s correlation with commodity prices.

- Precious Metals Shine as Dollar Weakens: Gold futures for April delivery saw a substantial rise, closing up at $2,014.90 per ounce, amidst a softening dollar and lower-than-expected US jobless claims, which came in at 212,000 versus an anticipated 220,000. Silver followed suit, with its price reaching towards $23.00 per ounce, driven by a decrease in the 10-year Treasury yield.

- AUD/USD Finds Support Amid Mixed Economic Signals: Despite Australia’s Q4 GDP growth coming in at 2.2%, below the forecasted 2.5%, the AUD/USD pair managed to edge higher to 0.6520, marking a 0.40% increase. This resilience comes as the market weighs the broader implications of the US’s economic indicators against the backdrop of anticipated policy shifts by the Federal Reserve.

- USD/JPY Navigates Policy Uncertainty and Recessionary Pressures: The USD/JPY pair’s pullback from levels above 150.00 to 149.95 underscores the market’s reaction to Japan’s economic setbacks and speculation regarding the Bank of Japan’s monetary policy direction. Investors remain vigilant for any signs of intervention or significant policy adjustments in response to Japan’s recessionary status.

Market Movers:

- Zebra Technologies Leads S&P 500 Gainers: Zebra Technologies (ZBRA) saw its shares rally more than 12% after reporting first-quarter net sales of $1.01 billion, surpassing the consensus estimate of $996.4 million. This surge underscores the company’s robust performance and investors’ positive response to its growth trajectory.

- CBRE Group Surpasses Revenue Expectations: CBRE Group (CBRE) experienced a notable share price increase of over 8% following a fourth-quarter revenue report of $8.95 billion, significantly beating the consensus of $8.47 billion. This performance highlights CBRE’s strong position in the real estate services market.

- Epam Systems Optimistic Revenue Forecast: Shares of Epam Systems (EPAM) closed up more than 8% after the company provided a positive revenue outlook for Q1, projecting between $1.16 billion and $1.17 billion. This forecast reflects confidence in continued demand for Epam’s software engineering and IT consulting services.

- Airbnb Leads Nasdaq 100 After Earnings Beat: Airbnb (ABNB) saw its shares climb more than 6%, leading the gains in the Nasdaq 100, buoyed by analysts upgrading their price targets by an average of 7.4% following a strong earnings report. This uptick signals strong market confidence in Airbnb’s recovery and growth prospects post-pandemic.

- Targa Resources Reports Strong Earnings and Outlook: Targa Resources (TRGP) shares rose more than 5% after the company reported a Q4 adjusted Ebitda of $959.9 million, exceeding expectations, and provided an optimistic Ebitda forecast for 2024 of $3.7 billion to $3.9 billion. This guidance reflects the company’s strategic positioning in the midstream energy sector.

- AppLovin Surges on Revenue Growth: AppLovin (APP) shares soared more than 24% after reporting fourth-quarter revenue of $953.3 million, outperforming consensus estimates. This surge reflects the growing enthusiasm for AppLovin’s platform and technology solutions in the digital advertising space.

- West Pharmaceutical Services Leads S&P 500 Declines: West Pharmaceutical Services Inc (WST) saw its shares plummet more than 14%, leading the S&P 500’s decliners after its Q4 net sales of $732 million fell short of expectations.

- Deere & Co Adjusts Profit Outlook Downward: Deere & Co (DE) shares dropped more than 5% after the company revised its full-year profit forecast downwards, reflecting uncertainties in the agricultural machinery market.

As the curtain falls on a week troubled with economic twists and turns, the financial markets have once again proven their resilience and capacity for surprise. From the recessionary pressures in the UK and Japan to the large strides in US equity markets reaching new heights, investors have navigated a complex landscape with a keen eye on corporate earnings and macroeconomic indicators. The standout performances of companies like Zebra Technologies and Airbnb, alongside the challenges faced by giants such as Deere & Co, reveal the complex nature of market dynamics. As we move forward, the relationship between economic resilience, corporate strategy, and investor sentiment will continue to shape the narrative of global markets, underscoring the importance of adaptability and foresight in the evolving economic saga.