The Dow Jones Industrial Average closed 303 points lower, reflecting a broader sentiment of caution among investors. This outlook was prompted by a notable rise in the 10-year Treasury yield, which topped 4%, signalling a potential slowdown in the Federal Reserve’s monetary policy easing. Amidst these macroeconomic developments, corporate earnings reports painted a diverse picture, with major banks like Goldman Sachs and Morgan Stanley revealing their financial health, further influencing market dynamics. This intricate chemistry between rate speculations and quarterly earnings underscores the heightened sensitivity of markets to both economic indicators and corporate performance.

Key Takeaways:

- Dow’s Significant Drop: The Dow Jones Industrial Average ended the day with a substantial declined of 0.8%. This downturn highlights the market’s sensitivity to the current economic environment. The S&P 500 was flat (0.27%).

- Treasury Yield Surges: The benchmark 10-year Treasury note yield witnessed a significant jump, rising 12 basis points to reach 4.071%. This increase follows comments from Federal Reserve Governor Christopher Waller, suggesting a more cautious approach to monetary policy easing.

- European and Asian Markets’ Decline: The Stoxx 600 in Europe fell by 0.3%, while major Asian markets also saw a downturn, including a halt in Japanese stocks’ recent rally.

- UK Wage Growth Slows: In the UK, wage growth slowed to 6.5% in the three months to November, with the pound falling 0.72% against the dollar.

- Energy Sector’s Decline: The energy sector within the S&P 500 dropped 2.1%, influenced by a decrease in oil prices and a strengthening U.S. Dollar. Notable energy companies EQT, APA, and EOG Resources each fell approximately 3.4%.

- Spirit Airlines’ Major Fall: Shares of Spirit Airlines plunged dramatically by 47% following an antitrust ruling against JetBlue Airways’ proposed acquisition.

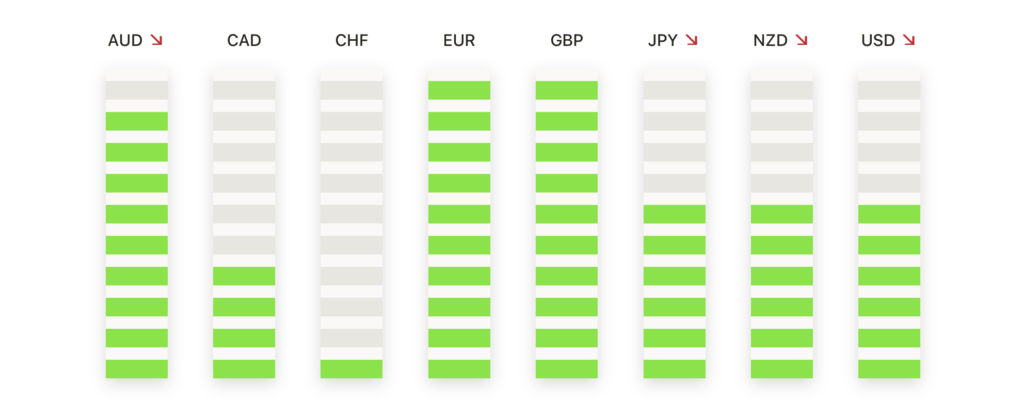

FX Today:

- Euro Under Pressure: The EUR/USD pair saw a notable decline, breaching the crucial 1.0930 level and moving towards the 200-day simple moving average near 1.0840. This move indicates a bearish sentiment, with a potential slide towards 1.0770 if the current support levels fail.

- Pound Sterling Weakens: GBP/USD also witnessed a significant downturn, breaking through channel support and approaching the 50-day simple moving average around the 1.2600 mark. A further breakdown could expose the pair to the 200-day simple moving average, indicating a bearish outlook for the Pound.

- Australian Dollar’s Struggles: The AUD/USD pair continued its downward trend, hovering above key support near 0.6570. This level is critical, aligning with the 200-day SMA and a long-term trendline. A breach here could see the pair heading towards 0.6525 and potentially 0.6500.

- Canadian Dollar’s Mixed Performance: The Canadian Dollar (CAD) fell against the U.S. Dollar, with the USD/CAD pair rising back into the 1.3500 region. This movement came despite the CAD gaining against other major currencies like the JPY and AUD.

- Oil Market Dynamics Amidst Currency Fluctuations: The oil market experienced a volatile day, with West Texas Intermediate (WTI) U.S. Crude Oil consolidating just above the $72.00 per barrel mark. Geopolitical tensions, particularly surrounding Houthi attacks on civilian cargo ships in the Red Sea, contributed to the market’s uneasiness. Despite these concerns, U.S. Crude Oil stocks remained well-supplied, with the EIA reporting a slight increase in net output, led by production gains in the Permian Basin.

Market Movers:

- Boeing’s Steep Decline: Boeing shares fell sharply, dropping 7.9% after Wells Fargo downgraded the stock from overweight to equal weight. This move reflects ongoing concerns regarding the 737 Max 9 model and its impact on the company’s performance.

- AMD’s Upward Surge: Advanced Micro Devices (AMD) saw its shares jump nearly 8%, closing at $158.74. This increase followed positive analyst commentary on semiconductor demand, contributing to the stock reaching a new 52-week high.

- Goldman Sachs and Morgan Stanley Earnings: Goldman Sachs reported a better-than-expected profit and revenue, leading to a slight increase of 0.1% in its shares. In contrast, Morgan Stanley experienced a decline of 4.7% in its shares after posting its quarterly earnings, despite a revenue beat in the fourth quarter.

- Nike and Chevron’s Downward Trend: Nike’s shares slipped more than 3%, while Chevron saw a decline of about 2%. These movements came amidst a broader downturn in the energy sector and shifting investor focus in consumer goods.

- Financial Sector Under Pressure: The financial sector witnessed a notable downturn, tumbling 5.2%. Within this sector, PayPal’s shares declined 4.6%, and T Rowe Price Group saw a drop of 3.9%.

- Dollar General’s Positive Shift: Dollar General (DG) enjoyed a rise of more than 2% after Morgan Stanley upgraded the stock to overweight from equal weight, reflecting a positive market outlook on the company’s growth potential.

- European Brand Hugo Boss Takes a Hit: In the European market, fashion brand Hugo Boss experienced a steep decline of 10%, following its earnings miss against analyst forecasts.

- Harbour Energy and Ocado’s Rise: Harbour Energy shares rose over 6% after analysts described the company as “a sleeping giant,” while Ocado’s stock increased by 5.8% on the announcement of its return to profit and strong retail revenue growth.

The financial markets paint a vivid picture of strategic realignment and responsive direction. The Dow’s retreat, set against the backdrop of fluctuating tech and energy stocks, signals a broader recalibration in investor sentiment. The day’s activity, from Boeing’s tumble to AMD’s ascent, exemplifies the delicate dance between corporate fortunes and market expectations. Investors, in this landscape, are not just observers but active participants, constantly adjusting their strategies to the rhythm of market indicators and corporate narratives.