As the Federal Reserve kicked off its two-day policy meeting, Wall Street’s major indexes climbed higher, with the Dow Jones Industrial Average leading the charge. While investors braced for the central bank’s interest rate decision, chipmaker Nvidia’s unveiling of its latest AI offering further fuelled excitement in the growing artificial intelligence sector. Elsewhere, the Bank of Japan’s historic move to end its negative interest rate policy and abolish yield curve control sent ripples through global markets. Global markets responded with a mix of excitement and caution, reflecting the anticipation for the Fed’s next moves and the transformative potential of tech innovations in shaping the economic landscape.

Key Takeaways:

- Dow Jones Industrial Average Climbs Significantly: The Dow Jones rallied impressively, adding 320.33 points to close at an increase of 0.83%. This performance marks the benchmark’s most substantial gain since early February.

- S&P 500 and Nasdaq Composite Experience Growth: The S&P 500 ascended by 0.56%, while the Nasdaq Composite saw a moderate increase of 0.39%. These movements underscore a broad-based confidence in the market, despite the looming uncertainties surrounding interest rate policies and inflation trajectories.

- Bank of Japan’s Historic Policy Shift Elevates Nikkei 225: The Bank of Japan’s announcement to end its negative interest rate policy and hike rates for the first time in 17 years significantly impacted Asian markets. Japan’s Nikkei 225 index responded positively, closing up 0.66% at 40,003.60, marking a pivotal moment in Japan’s monetary policy landscape and drawing global attention to its economic recovery efforts.

- European Markets Close Slightly Higher in Anticipation of Fed Meeting: European markets experienced a modest increase, with the pan-European Stoxx 600 closing up by 0.26%. This mixed sentiment was mirrored in sector-specific performances, where auto stocks rose by 1.2%, while food and beverage stocks dipped by 0.5%.

- Mixed Reactions in Asia-Pacific Markets to Central Bank Decisions: The Asia-Pacific region saw varied responses to the monetary policy adjustments, with South Korea’s Kospi falling by 1.10% and Hong Kong’s Hang Seng index sliding 1.13%, while Australia’s S&P/ASX 200 edged up by 0.36%. These movements reflect the diverse impacts of the Reserve Bank of Australia’s decision to maintain its benchmark rate and the Bank of Japan’s policy shift, highlighting the interconnectedness of global financial markets and central bank strategies.

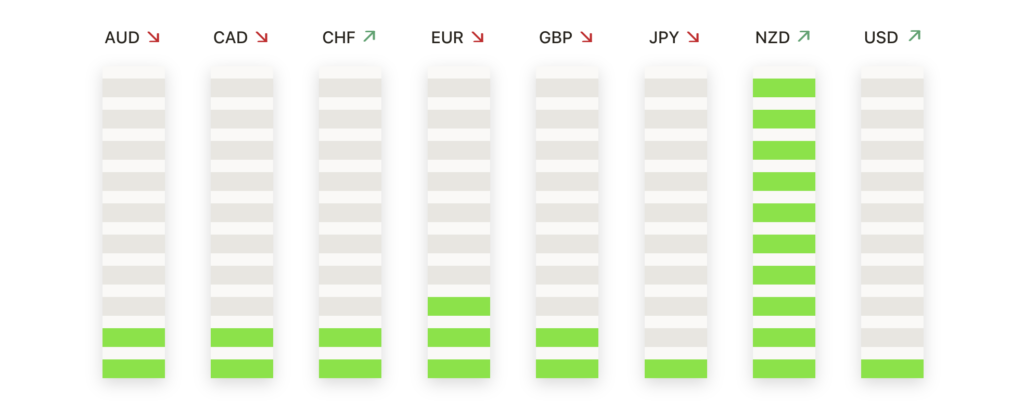

FX Today:

- USD/CAD Sees Volatility During Canada’s Inflation Report: The USD/CAD pair showcased notable fluctuations, peaking at a new year-to-date high before retracting below the 1.3600 threshold. The pair closing beneath the 1.3550 region might indicate potential for further losses. However, the 100-day moving average (DMA) at 1.3520 stands as a dynamic support, with further downside potentially halted at 1.3500 and the confluence of the 200 and 50-DMA at 1.3481/87. Conversely, a rebound above 1.3600 could prompt a challenge of the November 24 high at 1.3711.

- EUR/USD Tests Critical Support: The EUR/USD pair extended its decline, touching multi-week lows near the 1.0830 region. This downturn brings the critical 200-day Simple Moving Average (SMA) into the spotlight, as the pair struggles against a backdrop of monetary policy uncertainty and market sentiment, awaiting signals from upcoming speeches and economic indicators in the Eurozone.

- GBP/USD Recovers to Reclaim Key Levels: The GBP/USD pair managed to reverse an earlier dip to the 1.2670 zone, successfully climbing back beyond the 1.2700 mark. This resilience reflects market reactions to domestic fiscal and monetary cues, with investors closely monitoring the UK’s inflation data release for potential directional momentum.

- USD/JPY Nears Key Resistance Amid Yen Selling Pressure: The USD/JPY pair experienced a significant uptick, approaching the critical 151.00 mark. This movement is largely due to increased selling pressure on the yen, following the Bank of Japan’s unexpected rate hike. This highlights the intense scrutiny over Japan’s monetary policy shifts and their implications for currency valuations.

- AUD/USD Dips as Dollar Strengthens and RBA Maintains Rate: The AUD/USD pair continued its downward trajectory for the fourth consecutive session, nearing the pivotal 0.6500 support level. This decline reflects the combined impact of a strengthening dollar and the Reserve Bank of Australia’s decision to maintain its benchmark rate, with upcoming inflation expectations set to provide further guidance on the currency’s direction.

Market Movers:

- Unilever Climbs on Restructuring Plans: Shares of Unilever rose by 2.8% after the company announced its intention to spin off its ice cream division, which includes popular brands like Ben & Jerry’s and Magnum. This restructuring move, affecting about 7,500 jobs, sparked investor interest, contributing to the stock’s upward trajectory.

- Nvidia Rebounds on AI Chip Announcement: Nvidia’s stock gained more than 1% after recovering from an earlier dip. This surge was fuelled by the company’s unveiling of its next-generation artificial intelligence chips, dubbed Blackwell.

- Super Micro Computer Faces a Dip on Share Offering News: Super Micro Computer experienced a notable decrease, dropping nearly 9% following its announcement of a two million share offering. Despite a 220% surge earlier in the year driven by AI enthusiasm, this move, aimed at funding inventory purchases, capacity expansion, and R&D investments, has temporarily dampened investor sentiment.

- Cryptocurrency Stocks Tumble as Bitcoin Retreats: The retreat of bitcoin from its recent highs has adversely affected stocks closely tied to the cryptocurrency’s performance. MicroStrategy, a significant holder of bitcoin, saw its stock fall by 5.7%, while Coinbase dropped by 4%. Crypto mining companies also felt the pressure, with notable players like Riot Platforms and Marathon Digital experiencing declines 3% and 0.5%, respectively.

- Nordstrom Soars on Privatisation Speculations: Nordstrom’s stock jumped 9.4% amidst reports that the luxury department store chain is exploring going private. Working with investment banks, Nordstrom is reportedly assessing interest from private equity firms in a potential deal, sparking a significant uptick in its share price.

- Tencent Music Rallies After Earnings Report: Shares of Tencent Music Entertainment surged 6.4%, lifted by a quarterly report that showed a 20% year-over-year growth in paying users, despite a drop in total revenue compared to the previous year. This growth has bolstered investor confidence in the company’s market position.

- dLocal Slides Following Earnings Miss: The fintech company dLocal witnessed a sharp decline, falling nearly 17.5% after its earnings report fell short of expectations. The company reported a quarterly profit of 10 cents per share, missing the forecasted 15 cents, with its full-year revenue guidance also disappointing investors.

- Snowflake and MongoDB React to AI Market Dynamics: Snowflake and MongoDB saw divergent responses following market analysis downgrades, attributing the lack of a direct generative AI advantage. Snowflake managed a slight gain of 0.9%, while MongoDB faced a minor setback, dropping by 0.7%.

- Cognex and Chart Industries Benefit from Upgrades: Both Cognex and Chart Industries enjoyed positive market reactions following upgrades from UBS to buy from neutral. Cognex’s shares increased by 2.6%, while Chart Industries saw a 3.5% rise, driven by optimistic assessments of their growth prospects and operational execution.

- Endava Gains on Market Upgrade: British software firm Endava’s shares ascended by 4.6% after receiving an upgrade to overweight from neutral by JPMorgan, which highlighted a potential 32% upside from its current valuation, presenting a compelling case for investors despite a 50% decline in its stock price so far in 2024.

- Avis Budget Group’s Positive Outlook: Avis Budget Group’s stock advanced by 7% following a bullish initiation by Bank of America, which set a buy rating and a price objective significantly above the current market price, citing the car rental company’s attractive valuation and growth potential.

With the Federal Reserve’s policy meeting at the centre stage and large announcements from tech giants like Nvidia, investors have been kept on their toes. Amidst these developments, the significant shifts in the FX market, pivotal moves by major corporations, and the rollercoaster ride of cryptocurrency stocks show the complex relationship between economic policies, corporate strategies, and investor sentiment. As we look ahead, the market’s resilience and adaptability are important which reflects a keen anticipation for future economic cues and the unyielding pursuit of growth opportunities, even in the face of uncertainty.