Wall Street rebounded with a renewed energy on Monday, marking a significant resumption of its December rally. The Dow Jones Industrial Average led the charge, escalating by approximately 157 points to secure its third consecutive day of gains, closing at 36,404.93. This upward momentum, mirrored in the S&P 500 and Nasdaq Composite’s gains, highlights an optimistic investor sentiment, despite a backdrop of global economic uncertainties and anticipations of key inflation data. As the Federal Reserve gears up for its policy meeting, the financial markets stand at a pivotal stage, balancing optimism with cautious speculation about future interest rate movements and economic indicators.

Key Takeaways:

- Dow’s Impressive Climb: The Dow Jones Industrial Average underscored its bullish trend by gaining around 157 points, an increase of approximately 0.4%, to close at 36,404.93. This marks the Dow’s third consecutive day of gains, evidencing a resilient uptrend in the market.

- S&P 500 and Nasdaq Follow Suit: Complementing the Dow’s performance, the S&P 500 advanced by 0.39%, closing at 4,622.44. The Nasdaq Composite also added to the positive momentum, albeit modestly, with a 0.2% rise, ending the session at 14,432.49.

- Anticipation of Inflation Data and Federal Reserve’s Decision: The financial market’s ongoing rally is currently contrasted with the anticipation of November’s consumer price index and producer price index data. These figures are crucial as they could influence the Federal Reserve’s rate policy, with the Fed funds futures pricing suggesting a nearly 40% likelihood of a rate cut by a quarter of a point in March.

- Corporate Movements and Stock Fluctuations: Macy’s stock experienced a significant surge of over 19% due to a $5.8 billion buyout offer. Conversely, technology giants like Apple and Nvidia saw declines of 1.7% and 2% respectively, placing pressure on the Nasdaq. Meta Platforms also experienced a downturn, with shares ticking down by 2.1%.

- Global Market Responses and Bond Yield Trends: In the bond market, the 10-year T-note yield increased by 3.6 basis points to 4.262%. Globally, markets showed mixed responses, with the Euro Stoxx 50 rising by 0.33%, the Shanghai Composite Index closing up by 0.74%, and Japan’s Nikkei Stock Index climbing by 1.50%.

- Sector-Specific Movements: In the technology sector, chip stocks like Globalfoundries and Intel gained momentum, with Bloomberg Intelligence predicting robust fundamental growth for chip stocks in 2024. On the other hand, digital wallet and payment app companies including Meta Platforms, Amazon.com, and Alphabet, faced declines of more than 2% due to potential regulatory scrutiny.

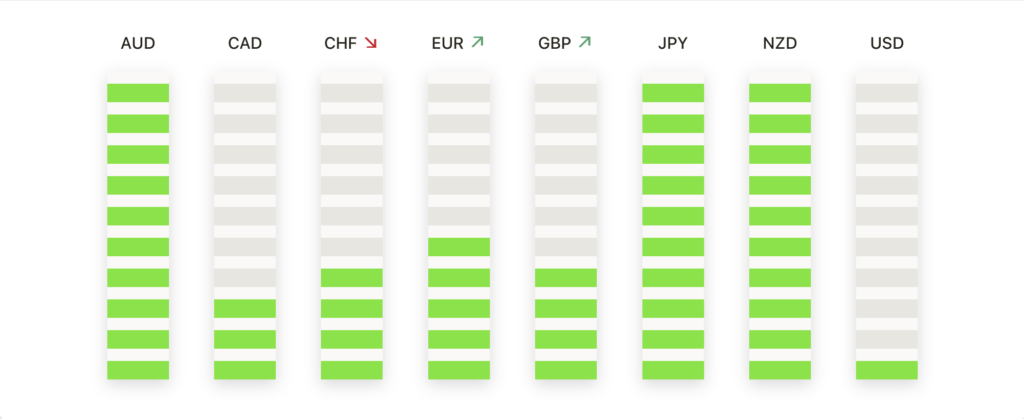

FX Today:

- GBP/USD Navigates Narrow Range: The GBP/USD pair remained relatively stable, trading within a tight band. The pair was seen hovering around the 1.2550 level, with minimal gains of 0.10%. The market’s focus is on the potential implications of upcoming US inflation data and central bank decisions, which could lead to significant shifts in the pair’s trajectory.

- EUR/USD Steady Amid Market Anticipation: The EUR/USD pair showed consolidation, holding around the 1.0764 level. Trading within the confines of the previous session’s range, the pair exhibited subdued price action. The market awaits key events, such as the ZEW survey and the European Central Bank’s policy meeting, which could influence the pair’s direction.

- USD/JPY Sees Upward Movement: The USD/JPY pair experienced an increase, climbing above the 146.00 mark. This rise represents a continuation of the pair’s rebound, reflecting a decrease in the likelihood of an immediate policy change from the Bank of Japan. The pair’s movement is closely tied to T-note yield shifts and global market sentiments.

- Swiss Franc’s Performance Against Major Currencies: The Swiss Franc (CHF) gained strength against most major pairs. Notably, the USD/CHF pair was down by 0.11%, while the EUR/CHF pair dropped by 0.14%. These movements highlight the CHF’s role as a safe-haven currency amidst global economic uncertainties.

- GBP/CHF Technical Outlook: The GBP/CHF pair showed a marginal bullish trend in the medium term, rising within a range corridor between 1.0990 and 1.1155. Technical analysis suggests a potential ascent back up to the range highs, with the MACD indicator supporting a short-term bullish outlook.

- Oil Prices Fluctuations: West Texas Intermediate (WTI) crude reached a daily high of around $71.77 during the US session, following marginal gains earlier in Asian and European markets. This volatility reflects ongoing concerns about supply and demand dynamics as the market anticipates updates from the Saudi Energy Minister on potential production adjustments. Technically, WTI shows signs of potential upside, facing immediate resistance just above $72.00, with further hurdles at the 20-day Moving Average of $74.63. Key support levels are identified at $70.00 and $67.00, while critical resistance levels to watch are at $72.16, $74.63, and $75.00, marking pivotal points for future price movements.

Conclusion:

Monday’s trading activities culminated in a watchful yet positive sentiment across global financial markets. The Dow’s notable advance underscores a complex interplay of year-end momentum and anticipation of key economic indicators. In the foreign exchange market, major currency pairs like GBP/USD and EUR/USD navigated through uncertainties shaped by central bank policies and global economic data, reflecting a cautious recalibration. Meanwhile, oil prices, particularly WTI, oscillated amid supply concerns and demand speculations, with a keen eye on potential production adjustments. As the markets close, investors remain attentive, balancing optimism with a pragmatic approach towards the forthcoming economic developments and central bank decisions that could redefine market trajectories.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.