In today’s trading session, the stock market displayed a fascinating tale of contrasts, with the Dow Jones Industrial Average reaching new heights, representative of the optimism among investors. This optimism stood in sharp contrast to the more passive performances of the S&P 500 and the Nasdaq Composite, which both retreated slightly. Such divergence underscores the complex relationship of expectations and realities facing the market, particularly in anticipation of critical inflation data and forthcoming corporate earnings reports. This highlighted the selective confidence investors placed in various market segments, influenced by global economic indicators, corporate news, and sector-specific developments.

Key Takeaways:

- Dow Jones Achieves New Milestone: The Dow Jones Industrial Average climbed 125.69 points, or 0.33%, to reach a record closing of 38,671.69, showcasing investor optimism amidst a landscape filled with anticipation for new data.

- S&P 500 and Nasdaq Show Divergence: Despite the Dow’s gains, the S&P 500 and Nasdaq Composite took a step back, with the S&P 500 dipping by 0.09% to end at 5,026.61 and the Nasdaq falling 0.3% to close at 15,990.66, reflecting the market’s mixed sentiment.

- European and Asian Markets Respond: The Stoxx 600 index closed 0.5% higher, while Asian markets showed a mixed performance amid a holiday-shortened week, highlighting global market reactions to regional and international economic cues.

- Sector-Specific Movements Influence Market: Salesforce and Hershey experienced declines, with Salesforce dropping 1.4% and Hershey slightly less than 1%, following a downgrade by Morgan Stanley due to softer demand concerns.

- Energy Sector Spotlight: Diamondback Energy surged nearly 10% after announcing its acquisition of Endeavor Energy Partners, signalling significant interest and potential shifts within the energy sector.

- Anticipation for Inflation and Earnings Reports: Investors are keenly awaiting fresh inflation data, with the Consumer Price Index (CPI) set for release, and earnings from 61 S&P 500 companies, which could provide further insights into the U.S. consumer health and inflation trends.

- Bitcoin Surges Past $50,000 Milestone: Bitcoin reached a notable high, touching the $50,000 level for the first time since December 27, 2021. The cryptocurrency’s significant jump to $49,899 represents a 4.96% increase on the day, underscoring a robust performance that has seen it climb 16.3% so far this year.

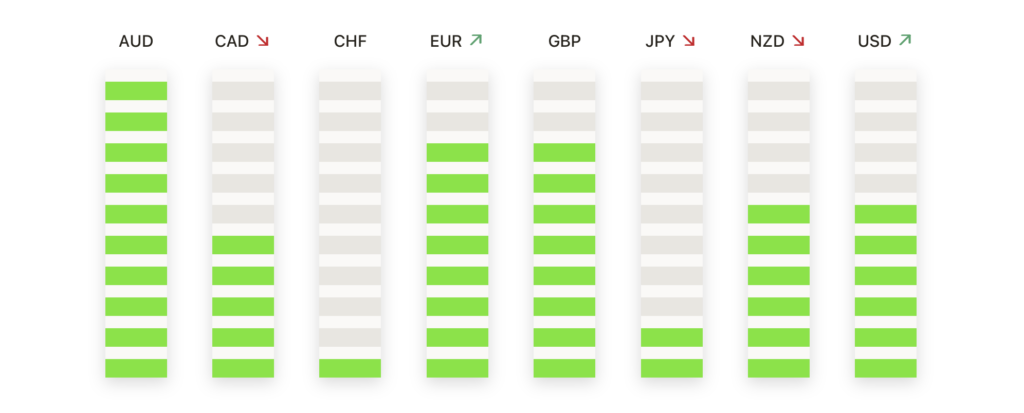

FX Today:

- Euro Tests Key Resistance Levels Against the Dollar: The EUR/USD pair approached the 1.0800 threshold but encountered resistance, reflecting a market poised on the brink of significant economic updates. Despite this challenge, the pair managed to climb from early February lows near 1.0720, indicating a cautious bullish sentiment among traders. Yet, the pair’s advance was halted, showcasing the critical nature of upcoming U.S. CPI data.

- Canadian Dollar Edges Higher in Anticipation of Economic Data: The Canadian Dollar (CAD) sees an uptick, gaining 0.3% against the New Zealand Dollar (NZD) and the Euro (EUR), and slightly advancing 0.05% versus the US Dollar (USD), with the USD/CAD pair settling below the 1.3500 mark, after a dip from 1.3540. The currency’s movement is closely tied to expectations from the upcoming US CPI data, with the CAD finding support near the 200-hour SMA and daily trading indicating consolidation just below the 200-day SMA at 1.3475, highlighting cautious optimism in thin trading conditions.

- US Dollar Showcases Stability with Key Data on the Horizon: The US Dollar positions itself at 104.10, marking a slight uptick as markets await a range of economic data. This week’s focal points include the Consumer Price Index (CPI), Producer Price Index (PPI), and January’s Retail Sales, which could influence the Dollar’s trajectory. The Relative Strength Index (RSI) hovers around 60, indicating bullish momentum, while the Moving Average Convergence Divergence (MACD) presents green bars, suggesting a positive outlook.

- Japanese Yen in a Holding Pattern as USD/JPY Stabilizes: The USD/JPY pair remained stable, with a minimal increase to 149.33, marking a slight gain of 0.03%. Positioned around the 149.20s, the currency pair awaits the forthcoming US inflation data with keen interest. The technical outlook shows the USD/JPY consolidating which suggest a period of indecision among traders. While the prospect of breaching the 150.00 threshold remains a point of caution, resistance levels are eyed at 151.38 and 151.91, corresponding to recent highs. Conversely, a drop below 149.00 could open a path toward 148.00.

- Oil Prices Retreat After Previous Gains: Following a more than 6% rally last week, oil prices fell, with West Texas Intermediate dropping 0.94% to $76.09 a barrel, and Brent crude decreasing 1% to $81.37 a barrel, amid ongoing Middle East tensions.

Market Movers:

- Tesla Adjusts to Market Sentiment: Shares of Tesla closed down more than 2%, as analysis from RBC Capital Markets highlighted a continued slowdown in electric vehicle sales, raising concerns among investors about the sector’s future growth. This decline reflects broader market apprehensions regarding the electric vehicle industry’s trajectory amidst shifting consumer demand and potential regulatory impacts.

- Salesforce Undergoes Insider Selling Pressure: Salesforce experienced a downturn, with its shares falling more than 1%, making it one of the Dow Jones Industrial Average’s significant detractors for the day. Insider selling activities came into focus after SEC filings revealed that CEO Marc Benioff sold shares worth $4.37 million, prompting a reassessment of internal confidence and future growth expectations among investors.

- VF Corp Elevates on Governance Optimism: VF Corp’s shares experienced a significant boost, climbing more than 13% and topping the S&P 500 gainers list. This surge was propelled by news that the company’s founding family supports the replacement of two board directors with nominees from Engaged Capital.

- AstraZeneca Faces Downward Revision After Earnings: AstraZeneca’s shares declined by more than 1% in response to Barclays cutting its 2024 EPS estimates by 2% following a weaker-than-expected earnings report. The adjustment highlights investor recalibration of growth expectations for the pharmaceutical giant in the face of financial performance and market challenges.

- Monday.com Faces Market Scepticism Despite Revenue Beat: Shares of Monday.com plummeted by more than 10%, as the market response to its Q4 results appeared lukewarm. Despite reporting Q4 revenue of $202.6 million, surpassing consensus estimates, the significant stock drop underscores the challenges tech companies face in aligning investor expectations with growth trajectories and profitability.

- Rivian Automotive Adjusts After Analyst Downgrade: Rivian Automotive saw its shares decline by more than 2% following a downgrade by Barclays from overweight to equal weight. This rating change reflects a reassessment of Rivian’s market position, growth potential, and the competitive landscape in the electric vehicle sector.

With the Dow Jones reaching a new high amidst a broader context of mixed index performances, the narrative of selective optimism becomes apparent. The contrasting fortunes of tech giants like Tesla and Salesforce against the backdrop of strategic acquisitions by companies such as Diamondback Energy highlight the calculus investors are making in real-time, as the market digests the implications of upcoming inflation data and earnings reports. Amidst this, the rally in sectors like energy and consumer discretionary showcases the market’s ongoing search for value and growth in a landscape shaped by evolving economic indicators and geopolitical tensions.