Major Headlines

- AUD gets a lift from better Chinese data.

- Gold and oil continue to push higher on geopolitical risk premium.

- Equities holding up, but rising yields and VIX pose short-term headwinds.

Key Points

- China’s data releases this morning showed some marginal signs of improvement, with retail sales, industrial production, unemployment, and Q3 GDP all printing better than expected. This gave the AUD a boost, and allowed traders to take some profit on AUDCAD longs from yesterday.

- Gold and oil continued to grind higher, with WTI pushing back above the $88 level and gold attempting a break above its 200DMA. Traders should keep a close eye on these levels, as a breakout could lead to further gains.

- For equities, there are a few positive tailwinds in play, such as seasonals, oversold conditions, and dovish Fed speak. However, there are also two big short-term headwinds: rising yields and rising VIX. Traders should be mindful of these downside risks.

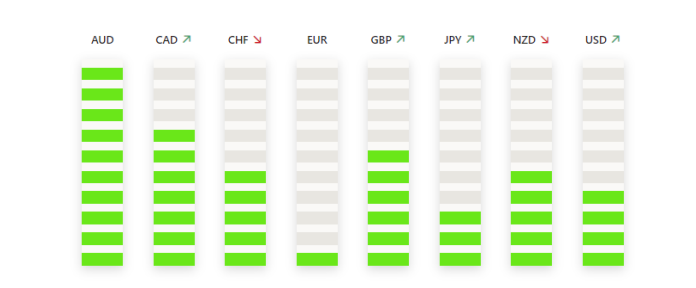

FX Strength Meter

The AUD is leading the major currencies to the upside today, following the better-than-expected Chinese growth data. The EUR is the weakest of the majors, but the catalyst for the move remains unclear.

Data to Watch

There is very little to get excited about on the data side today, with US housing data, EIA inventories, and Fed speak the main highlights.

- For the EIA data, big draws and builds will as always be in focus, but with the current geopolitical situation in the driver seat for price action, we might not get any meaningful reactions from the data.

- As for Fed speak, markets will be watching and listening to see any familiar dovish language like we had last week from Fed officials, and how last week’s CPI data might have changed their expectations for a November hike.

Overall, the market is likely to remain range-bound today, with traders awaiting more direction from the data and Fed speak.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.