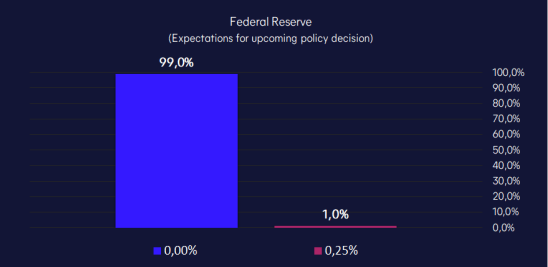

- FOMC Policy Decision

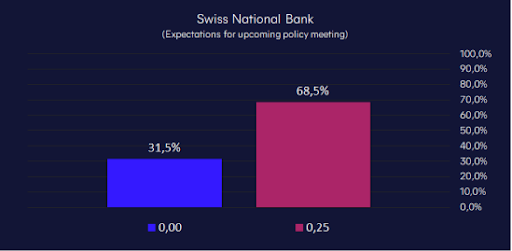

- SNB Policy Decision

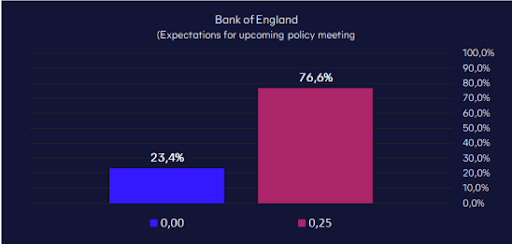

- BoE Policy Decision

Looking ahead, the upcoming week promises to be anything but dull, with nine central bank policy decisions slated for announcement.

This will be followed by the release of global flash PMIs on Friday. Ahead of these key events, the markets will also digest CPI data from Canada and the UK, though these are unlikely to sway the overall interest rate policy landscape. The real action starts mid-week, focusing on the Fed rate decision and any hints of a November rate hike.

While rate hikes are anticipated in the UK and the SNB, there are very important nuances traders will be watching that could create some fantastic trading opportunities. The week concludes with the BoJ decision and global PMI releases, which will put the ongoing narrative of US economic outperformance to the test once again.

FOMC Policy Decision

The Federal Reserve is widely expected to keep interest rates unchanged at its meeting on September 20. However, traders should remain alert to subtle cues in the Fed’s language and projections that could change the course of currencies, bond markets, and equities.

While recent economic indicators show easing inflation and a stabilised labour market, the Fed is keeping its options open for a potential rate hike later this year. The market is split over the likelihood of a November hike, with some FOMC members seeing it as a possibility while others are more cautious.

Traders will be watching closely the Dot Plot, which shows the individual projections of FOMC members for future interest rates. If the median dot for 2023 stays at 5.6%, it could trigger some hawkish price action in the USD. Traders will also be watching the Summary of Economic Projections (SEP) for insights into Fed officials’ expectations on GDP, unemployment, and inflation for the coming year.

Even if the Fed keeps rates unchanged, traders should be aware of the potential for volatility in the markets. Any comments or language from the Fed that suggests a change in policy stance could send shockwaves through the markets.

Key Takeaways for Traders:

- The Fed is expected to keep rates unchanged on September 20, but traders should watch for subtle cues in the Fed’s language and projections.

- The market is split over the likelihood of a November hike, with the Dot Plot and SEP providing important insights into the Fed’s thinking.

- Any comments or language from the Fed that suggests a change in policy stance could trigger volatility in the markets.

BoE Policy Decision

Key Takeaways for Traders:

- The Bank of England is expected to raise interest rates by 25 basis points to 5.5% at its meeting on September 22.

- This could be the last hike in this tightening cycle, as the BoE is expected to adopt a data-dependent approach and keep the door open for future decisions.

- However, the biggest surprise for markets would be a hold by the bank, which could lead to immediate downside pressure on the pound.

Implications for Markets:

- The GBP has been pressured in recent weeks due to concerns about a recession in the UK.

- A rate hike could support the pound in the short-term, but a more dovish stance from the BoE could weigh on the currency.

- Traders should be prepared for volatility in the GBP market ahead of the BoE meeting.

SNB Policy Decision

Will the Bank Finally Take a Breather?

Key Takeaways for Traders:

- Headline and core CPI have been below 2.0% for several months, while GDP is stagnant and the Manufacturing PMI is at its second-lowest level in the G20.

- The SNB has remained hawkish, but the recent data suggests that they may be at a crossroads.

- Market pricing leans towards a 25bps hike, but a surprise hold is possible, especially if the bank signals that they are concerned about the recent slowdown in growth.

- If the bank continues to stress that they will be propping up the CHF, traders should be cautious about shorting the currency.

Implications for Markets:

- A surprise hold or a dovish shift in the bank’s language could lead to a sell-off in the CHF.

- Continued hawkish rhetoric from the bank could support the CHF in the short-term, but a further slowdown in growth could eventually weigh on the currency.

- Traders should be prepared for volatility in the CHF market ahead of the SNB’s meeting on September 22.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.