Last week’s market summary

The past week was a tumultuous one for the capital markets, with bond yields surging, stocks falling, and the dollar gaining strength. However, there was a rapid shift towards the end of the week, with both short-sellers and dip buyers caught off guard.

Despite the wild moves in the bond market, which spooked equities, the consistent Q4 bullish seasonality for the stock market could offer a beacon of hope.

Upcoming US Data

The week ahead will put the US economy to the test with a string of important data releases, including the ISM Manufacturing and Services PMI, the September jobs report, and upcoming appearances by Federal Reserve Chair, Jay Powell.

The ISM Manufacturing index for September is anticipated to remain in contraction territory, with projections hinting at a slight dip to 47.4, compared to the previous 47.6. This would mark the 10th consecutive month of contraction for this key industry indicator.

In contrast, the services sector, a significant contributor to the U.S. economy, appears to be demonstrating resilience despite economic headwinds. The ISM Services index is expected to recede slightly to 53.7 in September from its previous mark of 54.5. An important factor to watch will be the inflationary pressures in the services sector, with increasing industries reporting higher prices paid.

The September jobs report, to be released on Friday, will be under intense scrutiny. With the Fed’s recent moves aimed at controlling inflation without spiking unemployment, the balance they achieve will be telling. Expectations are for the addition of 160K jobs in September, a decline from August’s 187K.

While the labour demand shows signs of cooling, with job openings dropping and small business hiring plans at near six-year lows, the unemployment rate is projected to edge down to 3.7%.

The pace of wage gains is also crucial; a predicted 0.3% increase in average hourly earnings for September could see the three-month annualized pace of wage growth fall below 4%.

USD Dynamics

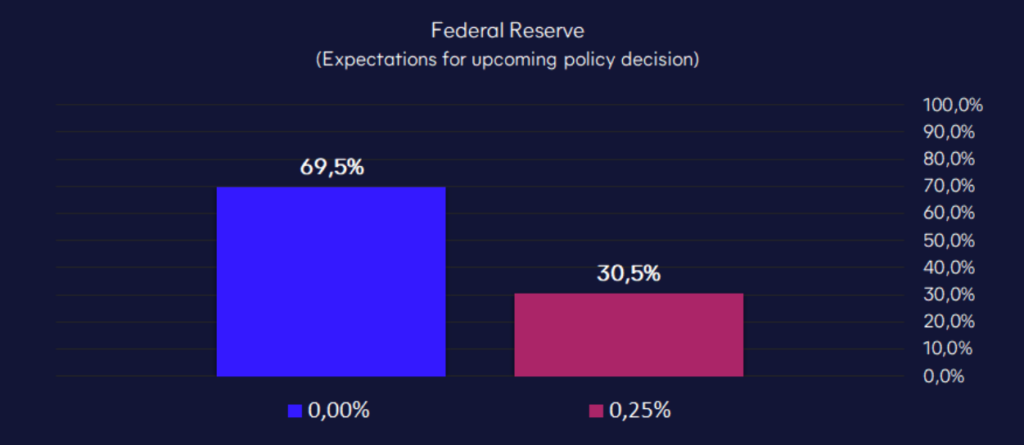

Given the data released recently, suggesting the U.S. consumer remains robust, and with no significant indicators suggesting early rate cuts by the Fed, the dollar is poised to maintain its strength.

However, given how stretched the recent upside trend has been, as well as stretched CFTC positioning data, the risk to reward for trying to chase the USD higher from here seems unattractive.

That means, looking for short-term opportunities to the downside on very bad data could be a better way to approach the week.

RBA Policy Decision: What to Expect

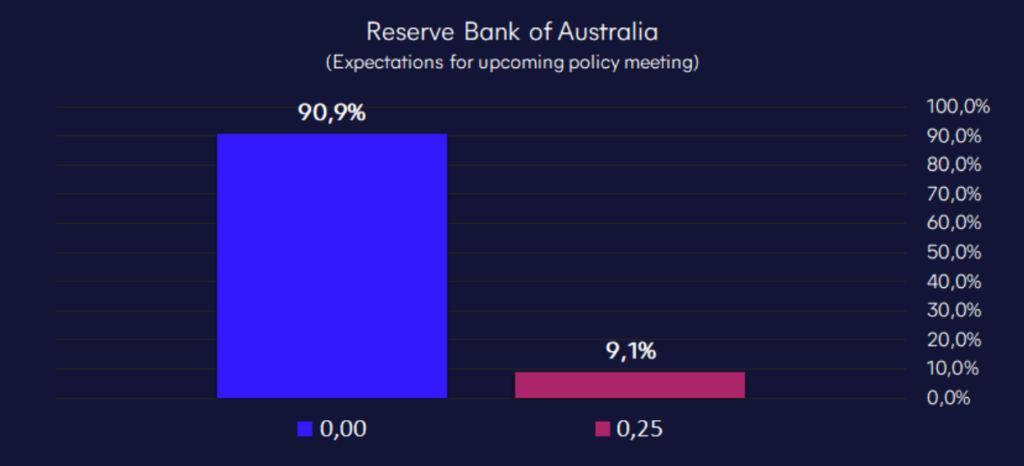

The Reserve Bank of Australia (RBA) is set to hold its monthly policy meeting next week, and markets and analysts are closely monitoring the potential for changes to the central bank’s key cash rate.

Key Takeaways for Traders

- Stance on Rates: The consensus is that the RBA will keep the Cash Rate Target unchanged at 4.10%. This forecast stems from a combination of recent macroeconomic data and signals from the RBA itself. Money markets currently price an 91% likelihood of no change and a 9% chance of a 25bps hike.

- Inflation Concerns: August’s Consumer Price Index (CPI) figure rose to 5.2% YoY, marking a notable acceleration from the previous month’s 4.9%. Although this inflation rate is substantially above the RBA’s target range of 2-3%, the surge can be attributed to base effects and rising oil prices. Furthermore, while the headline rate did meet expectations, the underlying inflationary pressures, especially in the services sector, have drawn attention.

- Labor Market Dynamics: Employment data has been positive, with job growth in August outperforming expectations (67k reported vs. an expected 23k). However, it’s essential to note that the majority of these new roles were part-time, and the previous month’s contraction in employment was adjusted to a less severe -1.4k from -14.6k.

- Change in Leadership: The upcoming RBA meeting will be the first under the leadership of the newly appointed Governor, Michele Bullock. Her stance on rates, particularly in her initial meetings, will be keenly watched.

- Chinese Economy & External Factors: The RBA has highlighted concerns about uncertainties in the Chinese economy, especially with regards to the property market. The central bank is likely to keep an eye on any significant developments in China, given its economic ties and potential spill-over effects.

- Future Outlook: Based on current data and RBA communications, one more rate hike down the line might be on the horizon. Many believe that the bank will wait for the quarterly inflation report, due on October 25th, and another set of staff projections in Nov before making a decision. Should they choose to hike, projections suggest a rise to 4.35%, with rates likely held steady after that.

RBNZ Policy Decision: What to Expect

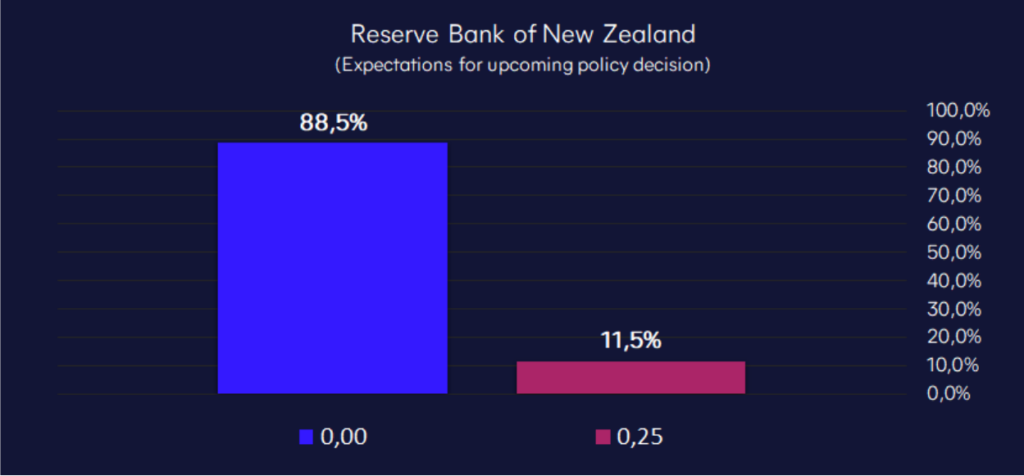

The Reserve Bank of New Zealand (RBNZ) is set to meet next week, and traders and analysts are eagerly awaiting the outcome. Based on the latest previews, here’s what to expect:

1. OCR Likely to Remain Unchanged at 5.5% Money markets strongly expect the RBNZ to keep the Official Cash Rate (OCR) at its current level of 5.5%. This is supported by the RBNZ’s commitment to keep the OCR “at restrictive levels for the foreseeable future.”

2. Economic Data Provides Support for a Hawkish Stance While the OCR is likely to remain unchanged, the economic backdrop provides a case for a more hawkish tone from the RBNZ. GDP grew at 0.9% QQ, significantly surpassing the RBNZ’s 0.5% QQ projection. Household consumption also saw growth of 0.4% QQ, defying expectations of a -1.8% drop.

3. Inflation and Housing Market Concerns Inflation remains a pertinent concern for the RBNZ, with August food prices up by 0.4% MM and new rents up by 1.0% MM. WTI oil prices have also risen meaningfully in the last 3 months, which could push petrol prices further up and intensify inflationary pressures. Concurrently, the housing market is seeing renewed momentum, with house prices growing by 0.7% m/m in August. This is largely due to the influx of nearly 100,000 migrants over the past year.

4. Uncertainty Remains Despite the evident pressures, the RBNZ’s previous statements suggest an air of caution. Governor Orr previously remarked that the OCR projection isn’t necessarily a robust indicator of the bank’s next move and emphasized the uncertainty surrounding future decisions. He also noted the necessity to “observe, worry and wait on rates.”

5. Key Takeaways for Traders Traders should closely monitor the RBNZ’s tone during the meeting, particularly for any indications of potential rate adjustments in the near future. Any discussions or mentions of the recent oil price increases, their potential impact on inflation, and the RBNZ’s stance on the housing market will be important as well. Further, traders should look for explicit mentions in the Summary Record of Meeting regarding any policy options discussed, as this could hint at the bank’s future course of action. For example, whether a hike was on the table or not.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.