The Dow Jones Industrial Average continued its winning streak on Wednesday, marking its sixth consecutive positive day and longest stretch of gains so far in 2024. The S&P 500 slightly lower, while the Nasdaq Composite pulled back slightly. Despite some tech giants faltering, with notable losses in companies like Uber and Intel, the broader tech sector managed a slight gain. This resilience in the face of mixed corporate earnings shows a broader market confidence, lifted by robust performances from key players like Amgen and JPMorgan Chase. Across the Atlantic, European stocks also advanced, lifted by a wave of optimistic earnings reports and a surprising rate cut by Sweden’s central bank, highlighting a day of complex but ultimately positive market movements.

Key Takeaways:

- Dow Marks Longest Winning Streak of 2024 As S&P 500 Holds Steady: The Dow Jones Industrial Average advanced 0.44% to close at 39,056.39, recording its sixth positive day in a row and the longest stretch of gains this year. The S&P 500 showed remarkable stability, lower by just 0.03 points to close nearly flat at 5,187.67.

- Nasdaq Composite Experiences a Pullback: Amid fluctuations in the tech sector, the Nasdaq Composite declined by 0.18%, ending the day at 16,302.76. This retreat reflects the mixed fortunes of tech giants, with companies like Uber and Intel seeing significant losses that impacted the index despite the broader tech sector managing a marginal overall gain of 0.2%.

- Stable Performance Among European Stocks: European markets reacted positively to fresh earnings insights, with the Stoxx 600 climbing 0.3%. The FTSE 100 Index is up 40.38 points or 0.49%. Notable movements included a 12.8% jump in Siemens Energy shares after the company raised its 2024 outlook, whereas BMW saw a 3% decline following a drop in profit margins.

- Challenges in Asia-Pacific Markets: In contrast, Asian markets faced tougher conditions. Japan’s Nikkei 225 led the losses, falling 1.63% to close at 38,202.37 after earnings reports from major corporations like Toyota Motor, which anticipates a nearly 20% drop in operating profit for the fiscal year ending March 2025.

- Interest Rate Speculations and Treasury Yields: Comments from Federal Reserve officials suggest a steady interest rate environment, with the 10-year Treasury yield inching up by 3 basis points to 4.492%. Boston Fed President Susan Collins emphasized the need for rates to stay consistent until inflation trends closer to the 2% target.

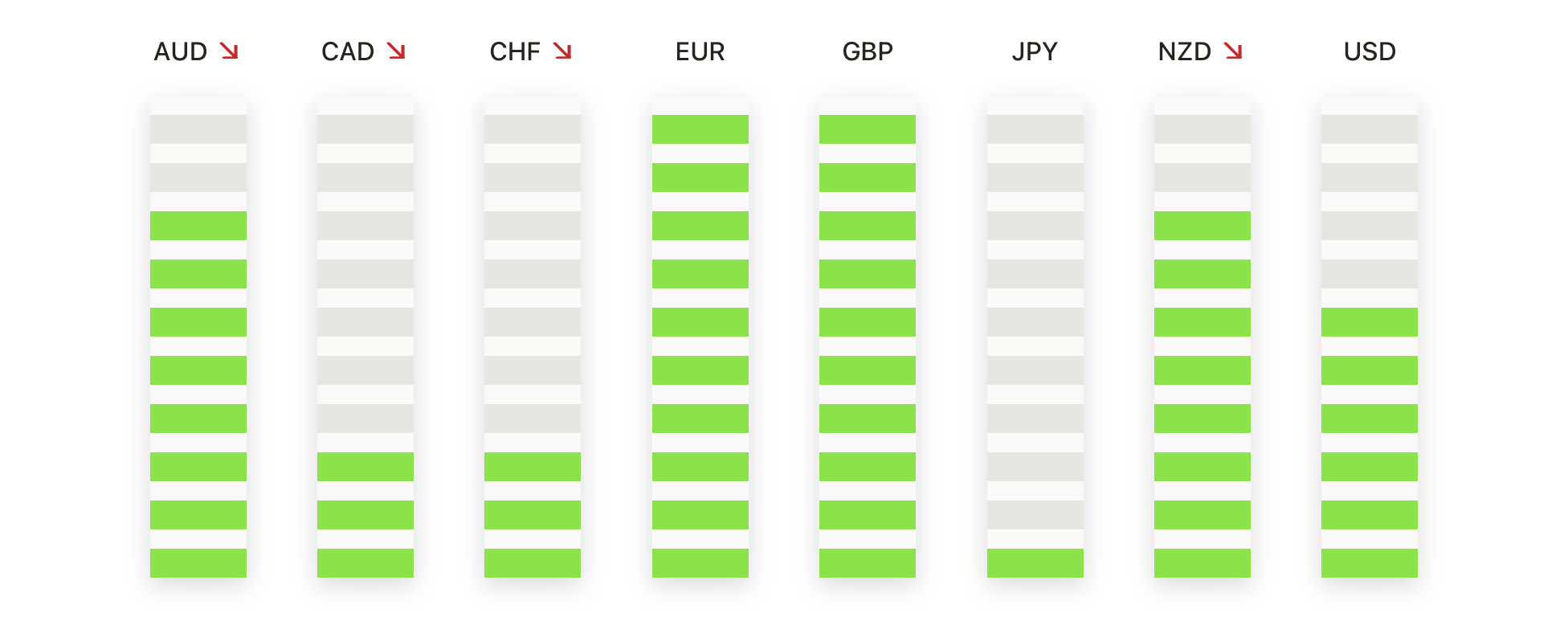

FX Today:

- USD/JPY Extends Gains Amid Rate Speculation: The dollar continued to strengthen against the Japanese yen, gaining 0.59% to close at 155.6. This uptrend is highlighted by the persistent low-interest rate environment in Japan compared to the US, fuelling speculation about potential interventions by Tokyo to support the yen.

- Euro Struggles Amid Anticipated ECB Rate Cuts: The euro weakened against the dollar, dipping 0.08% to $1.0745, reflecting concerns about the European Central Bank’s upcoming decision on interest rates, which could further influence the EUR/USD dynamics as the euro zone prepares for potential monetary easing.

- Sterling Holds Steady Before Key Policy Meeting: The British pound remained subdued, edging down 0.1% to $1.2492 against the dollar. Investors are bracing for the Bank of England’s upcoming meeting, which is keenly awaited for signs of future rate adjustments and its impact on GBP/USD.

- Canadian Dollar Shows Resilience: The Canadian dollar demonstrated some recovery, with USD/CAD decreasing to 1.3700. The CAD’s performance is partly tied to fluctuations in oil prices and domestic economic indicators, contributing to its short-term trading dynamics.

- Gold Prices Retreat Amid Rising Yields: Gold experienced downward pressure, with the spot price needing to surpass the recent high of $2,352 to maintain bullish momentum. Failure to break above this resistance could see prices retreat towards the $2,300 level, with potential support at the 50-day Simple Moving Average of $2,249.

- Silver Recovers After a Dip: Silver prices found support after briefly testing the $27.00 level. The metal’s price needs to clear the $27.70 resistance to target the year-to-date highs, with further resistance potentially at $28.00 and $28.49.

- AUD/JPY Encounters Resistance: The AUD/JPY pair showed some gains but faced resistance at 102.42. Overcoming this level could pave the way for retesting the year-to-date high near 104.95. If the resistance holds, the pair might retreat towards the 102.00 support, with additional downside potential at 101.36.

Market Movers:

- Uber Technologies Faces Setback: Uber shares tumbled by 5.7% following mixed first-quarter results, which included a surprising net loss and weaker-than-expected bookings revenue. The ride-hailing giant’s revenue reached $10.13 billion, marginally above analysts’ forecast of $10.11 billion, but the loss per share of 32 cents was a disappointment against expectations of earnings of 23 cents per share.

- Intel Revises Revenue Expectations Downward: Intel’s stock fell 2.2% after the company adjusted its second-quarter revenue guidance downwards. Following the U.S. Department of Commerce’s decision to revoke export licenses for China-based Huawei, Intel now anticipates revenues to fall below $13 billion for the quarter.

- Lyft Surges on Growth Optimism: Lyft saw its shares increase by 7.1% after reporting first-quarter revenues that exceeded forecasts. The company reported revenues of $1.28 billion against the consensus estimate of $1.16 billion, signalling faster-than-expected growth which buoyed investor sentiment.

- Shopify Plunges on Future Revenue Concerns: Shares of Shopify plummeted nearly 19% as the company’s guidance for current quarter revenue and profit failed to reassure investors, despite posting better-than-expected results for the last quarter. The e-commerce platform forecasted year-over-year revenue growth in the high teens, aligning with Street estimates but indicating a slowdown from previous quarters.

- Toyota Forecasts Lower Annual Operating Profit: Toyota Motor predicted a nearly 20% decline in its operating profit for the fiscal year ending March 2025, projecting ¥4.3 trillion ($27.7 billion) compared to ¥5.35 trillion in the previous year.

- Electronic Arts Underwhelms with Q4 Results: Electronic Arts shares dropped more than 3% following disappointing fiscal fourth-quarter outcomes. The video game developer reported adjusted earnings of $1.37 per share on net bookings of $1.67 billion, falling short of the expected $1.52 per share on $1.78 billion in revenue. Guidance for the upcoming quarter also did not meet analyst expectations.

- Arista Networks Climbs on Strong Earnings: Arista Networks experienced a 6.5% rise in stock value after surpassing first-quarter earnings expectations. The company achieved $1.99 in earnings per share on revenue of $1.57 billion, outperforming the estimated $1.74 in earnings per share on $1.55 billion in revenue.

- Twilio’s Guidance Disappoints Investors: Twilio’s shares declined by 7.5% after the cloud communications firm provided lower-than-expected revenue guidance for the second quarter. The company expects revenue to range between $1.05 billion and $1.06 billion, below the consensus estimate of $1.08 billion.

- Affirm Holdings Drops Despite Beating Estimates: Shares of Affirm fell 9.5% even though the “buy now, pay later” company reported fiscal third-quarter results that exceeded Wall Street’s expectations. Affirm reported a loss of 43 cents per share on revenue of $576 million, better than the forecasted loss of 70 cents per share on $549 million in revenue.

- Teva Pharmaceuticals Advances on Strong Sales: Teva Pharmaceuticals’ stock advanced nearly 13% after the company reported first-quarter revenue of $3.82 billion, exceeding expectations of $3.73 billion. The company highlighted significant growth in its generics business and key treatments like migraine medication Ajovy and Huntington’s disease treatment Austedo.

As today’s trading session closes, the market landscape presents a mixture of gains and losses across major indices and individual stocks. The Dow Jones’ sixth consecutive day of gains contrasts sharply with the mixed performances in the tech sector, where companies like Uber and Intel faced setbacks, reflecting the high expectations and volatile nature of tech investments. European markets show resilience amid rate cuts and positive earnings, while Asian markets struggle under the weight of disappointing corporate results. The varied movements in the forex and commodity markets further highlight the global interconnectedness and the delicate balance of investor sentiment, economic data, and geopolitical developments. This dynamic relationship continues to shape market trajectories, offering both challenges and opportunities for investors navigating the evolving economic landscape.