Global stock markets ended lower on Thursday, reacting sharply to new economic data that revealed a significant slowdown in US economic growth alongside persistent inflation pressures, restarting fears of a recession-inflation scenario. The Dow Jones Industrial Average, along with the S&P 500 and Nasdaq Composite, all registered declines as investors digested these implications. The economic figures have revived concerns regarding the Federal Reserve’s ability to manoeuvre interest rates amidst ongoing inflationary challenges, casting a shadow over the market’s outlook and shaking investor confidence.

Key Takeaways:

- Dow Jones Industrial Plummets: The Dow Jones Industrial Average saw a significant decline, dropping 375.12 points or 0.98%, to close at 38,085.80, pressured by significant losses in major corporations like Caterpillar and IBM.

- S&P 500 and Nasdaq Follow Suit: Reflecting broader market sentiments, the S&P 500 fell 0.46% to end the session at 5,048.42, while the Nasdaq Composite decreased by 0.64%, closing at 15,611.76, as tech stocks struggled amid economic concerns.

- US Economic Growth Slows: US GDP growth decelerated sharply to 1.6% in the first quarter, missing expectations of a 2.4% increase. This slowdown signals potential challenges ahead for the US economy.

- Inflation Concerns Intensify: The personal consumption expenditures price index rose at a 3.4% pace, notably above the prior quarter’s 1.8%, highlighting ongoing inflationary pressures that complicate the Federal Reserve’s policy decisions.

- Federal Reserve Rate Cut Expectations Diminished: Following the GDP report, expectations for Federal Reserve interest rate cuts have been scaled back, with market predictions now foreseeing only one rate cut within the year.

- European Markets Dip: The pan-European Stoxx 600 index ended the day down by 0.6%, with industrial stocks taking the hardest hit, declining 1.9%. Meanwhile, healthcare stocks managed a slight gain of 0.2%, indicating selective sector resilience. The FTSE 100 saw an uptick of 0.48%, adding 38.48 points to close at 8,078.86.

- Asian Markets Show Mixed Responses: Japan’s Nikkei 225 took a steep dive, losing 2.16% to close at 37,628.48. The Topix also fell, down 1.74%. In contrast, China’s markets showed some resilience; the Hang Seng index rose by 0.39% and the CSI 300 index edged up by 0.25%. South Korea’s Kospi ended the day lower by 1.76%, despite reporting strong GDP growth.

- Oil Prices Surge in Response to Economic Uncertainty: Crude oil futures experienced an uptick, closing up 0.92% at $83.57 a barrel for the West Texas Intermediate (WTI) June contract. This increase was a reaction to the underwhelming US GDP data and ongoing geopolitical tensions, reflecting heightened market volatility. The Brent June contract also saw gains, rising by 1.12% to close at $89.01 a barrel.

- Treasury Yields Surge: The yield on the benchmark 10-year Treasury note rose to 4.702%, reflecting the highest level in over five months, driven by the gloomy GDP report and inflation figures.

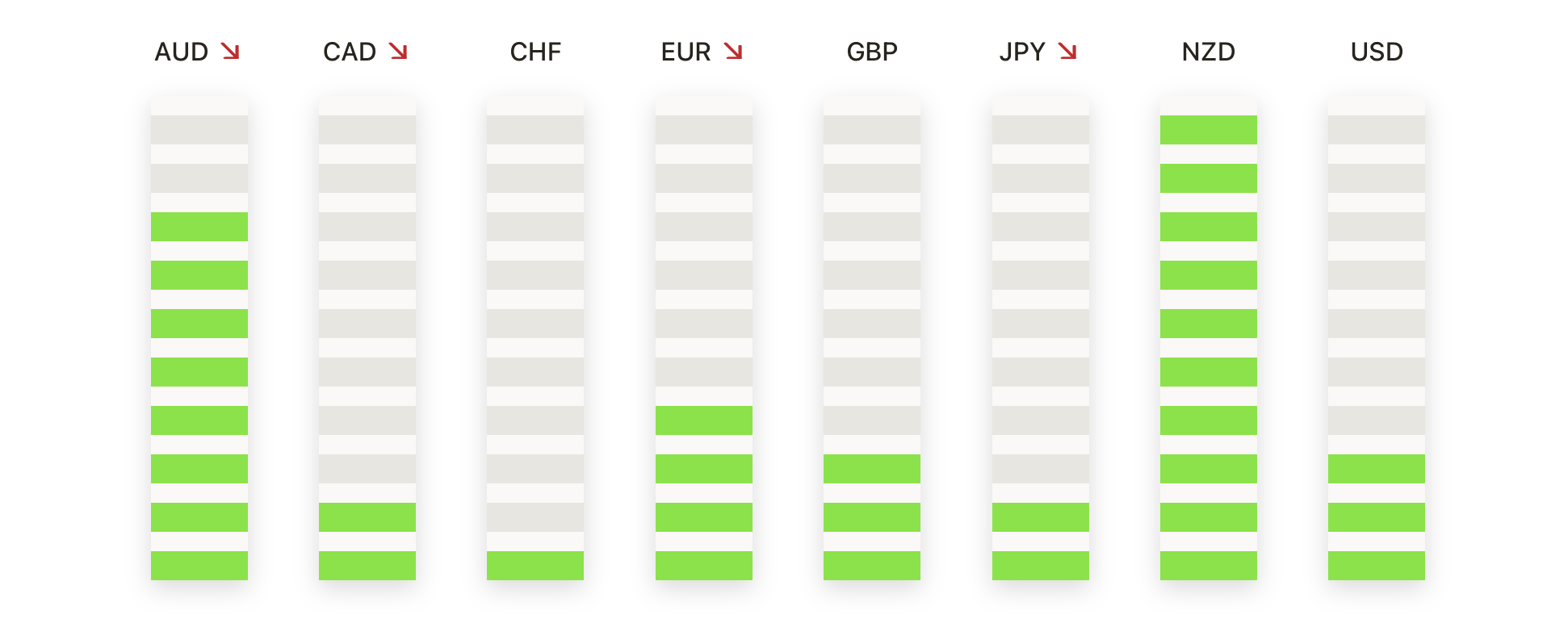

FX Today:

- GBP/USD Shows Resilience Amid Market Volatility: The British Pound managed a modest recovery against the US Dollar, with GBP/USD extending its climb above the 1.2500 level. The pair is now aiming for key resistance at the 200-day moving average (DMA) of 1.2559, with further potential resistance near 1.2600, marked by the 50 and 100-DMAs.

- AUD/USD Faces Resistance Amid Positive Sentiment: The Australian Dollar exhibited strength against the US Dollar, lifted by positive risk sentiment and better-than-expected domestic inflation figures. AUD/USD encountered resistance around the simple moving averages between 0.6502 and 0.6533, signalling a critical point for potential upward movement toward the 0.6650 level.

- USD/JPY Reaches for New Heights: The USD/JPY pair continued its rise, breaking past the critical 150.00 mark and aiming for higher resistance at 150.85. This movement reflects heightened doubt of Japan’s economic outlook and its implications for currency valuations, made worse by the Bank of Japan’s monetary policy discussions regarding potential intervention to support the yen.

- EUR/USD Navigates Uncertain Waters: The EUR/USD pair saw fluctuations amid mixed signals from the US economic landscape, climbing from the 1.0800 level to touch 1.0840. Throughout the week, the pair traded within a narrow range, highlighting ongoing uncertainty and market anticipation for clearer directional cues.

- CAD Struggles for Direction Amid Mixed Data: The Canadian Dollar faced challenges maintaining momentum against the US Dollar, with USD/CAD hovering around the 1.3700 mark. The pair tested support at 1.3660 and resistance near the 200-hour Exponential Moving Average (EMA) at 1.3710, indicating a tight consolidation phase as markets digested mixed US data.

- Gold Rallies as Economic Concerns Mount: Gold prices edged higher, testing resistance at the $2,337 mark, as investors sought safe havens amid growing economic uncertainties. If the metal breaches this resistance, the next targets could be the psychological barrier at $2,350 and potentially the $2,400 level. On the downside, a fall below the April 15 daily low of $2,324 might set the stage for a retest of lower supports at $2,300 and the March 21 high at $2,222.

Market Movers:

- Alphabet (GOOGL) Soars on Strong Earnings: Alphabet shares surged approximately 15% in extended trading as the tech giant posted first-quarter earnings of $1.89 per share, surpassing analysts’ expectations of $1.51 per share. Revenue also outperformed, reaching $80.54 billion against projections of $78.59 billion. The company’s robust financial health was further highlighted by its announcement of its first-ever dividend alongside a $70 billion buyback program.

- Microsoft (MSFT) Climbs After Earnings Beat: Microsoft’s stock climbed 4.5% following the announcement of fiscal third-quarter results that exceeded Wall Street expectations. The strong performance underscores the software maker’s ongoing market dominance and operational efficiency.

- Snap (SNAP) Jumps on Surprising Results: Snap’s shares soared over 27% in after-hours trading, driven by first-quarter results that exceeded analyst forecasts. Revenue grew 21% to $1.19 billion, primarily fuelled by significant improvements in the company’s advertising platform.

- Intel (INTC) Declines on Sales Miss: Intel’s shares fell by 8% in extended trading after the tech firm reported weaker-than-expected sales for the first quarter and provided a subdued forecast for the current quarter, despite beating earnings expectations set by Wall Street.

- Dexcom (DXCM) Drops Despite Beating Estimates: Dexcom’s stock fell 8%, even though the company reported higher-than-expected earnings of 32 cents per share on revenue of $921 million, compared to anticipated earnings of 27 cents per share on revenue of $909.9 million.

- Gilead Sciences (GILD) Gains on Narrower Loss: Shares of Gilead Sciences jumped almost 3% after the biotech firm reported a quarterly loss of $1.32 per share, which was narrower than the expected loss of $1.49 per share. Revenue of $6.69 billion also exceeded forecasts, providing a positive outlook for the company.

- Skechers (SKX) Advances on Strong Earnings Report: Skechers’ shares advanced more than 7% after the company reported first-quarter earnings of $1.33 per share and revenue of $2.25 billion, surpassing the expected earnings of $1.10 per share and revenue of $2.2 billion.

- L3Harris Technologies (LHX) Rises on Impressive Results: L3Harris Technologies’ stock rose nearly 2% after the aerospace and defence company reported an adjusted EPS of $3.06, beating the consensus estimate of $2.90 per share. Revenue of $5.21 billion also came in higher than the expected $5.11 billion.

- Meta Platforms (META) Leads Decliners After Disappointing Forecast: Meta Platforms’ shares fell more than 10% as the company forecasted Q2 revenue between $36.5 billion and $39 billion, which was below the consensus estimate. The firm also raised its full-year total expenses forecast, further dampening investor sentiment.

- Newmont (NEM) Leads Gainers on Strong Sales: Newmont’s stock rose more than 12%, leading gainers in the S&P 500 after the company reported first-quarter corporate sales of $4.02 billion, significantly surpassing the consensus estimate of $3.61 billion.

As April draws to a close, the financial landscape is marked by a mix of caution and volatility, with global markets reacting sharply to the latest US economic indicators. The reported slowdown in GDP growth alongside long-standing inflation concerns has led to a reshuffle of expectations around the Federal Reserve’s monetary policy, contributing to declines across major stock indexes. Meanwhile, notable gains in sectors such as mining and robust performances from tech giants like Alphabet suggest areas of resilience and growth potential. Investors continue to navigate this complex environment, balancing immediate economic data with long-term market forecasts, indicating a period of heightened doubt and strategic adjustments in the coming months.