The stock market session saw the Dow Jones Industrial Average extend its winning streak, the longest since December, signalling a slightly optimistic outlook among investors hoping for interest rate cuts by the Federal Reserve. Despite these gains, the Nasdaq Composite slightly retreated, indicating a mixed sentiment particularly within the technology sector. This subtle market behaviour underscores a day filled with both optimism and specific challenges, as traders weighed corporate earnings against broader economic signals and potential monetary policy shifts.

Key Takeaways:

- Dow’s Fifth Day of Gains: The Dow Jones Industrial Average continued its upward trend, marking a fifth consecutive day of gains and closing up by 31.99 points, or 0.08%, to reach 38,884.26. This streak is the longest since December, indicating sustained investor interest despite mixed market signals.

- S&P 500 Edges Higher: The S&P 500 advanced modestly, adding 0.13% to its value, ending the day at 5,187.70. This movement reflects a careful optimism among investors, balancing between earnings reports and economic forecasts.

- Nasdaq Faces Minor Retreat: Contrasting with the gains seen in other indices, the Nasdaq Composite fell slightly by 0.1%, closing at 16,332.56. This dip is the result of mixed performances in the tech sector, influenced by varying earnings outcomes and market expectations.

- Interest Rate Speculations Impact Yields: Yields on the 10-year Treasury note decreased by approximately 3 basis points to 4.45%, as investors reacted to clues about potential rate cuts by the Federal Reserve, showing the market’s sensitivity to monetary policy shifts.

- European Markets Surge: European stocks experienced a robust trading day, hitting their highest levels in over a month. The Stoxx 600 index closed 1.15% higher, led by financial services which surged 2.62%. The FTSE 100 rose by 1.22% to 8,313.67, while the CAC and the IBEX saw gains of 1% and 1.5% respectively.

- Asian Markets Show Mixed Results: Asian markets displayed varied performances with South Korea’s Kospi climbing 2.16% to 2,734.36, marking a significant gain. Japan’s Nikkei 225 resumed trading after a holiday to end up 1.57% at 38,835.1. Conversely, Hong Kong’s Hang Seng index fell by 0.51%, snapping a 10-day winning streak.

- Oil Market Fluctuations: The oil market showed minor adjustments amidst geopolitical uncertainties and strategic reserve activities. West Texas Intermediate for June closed down by 10 cents at $78.38 a barrel, and Brent crude for July also fell, down 17 cents to $83.16 a barrel.

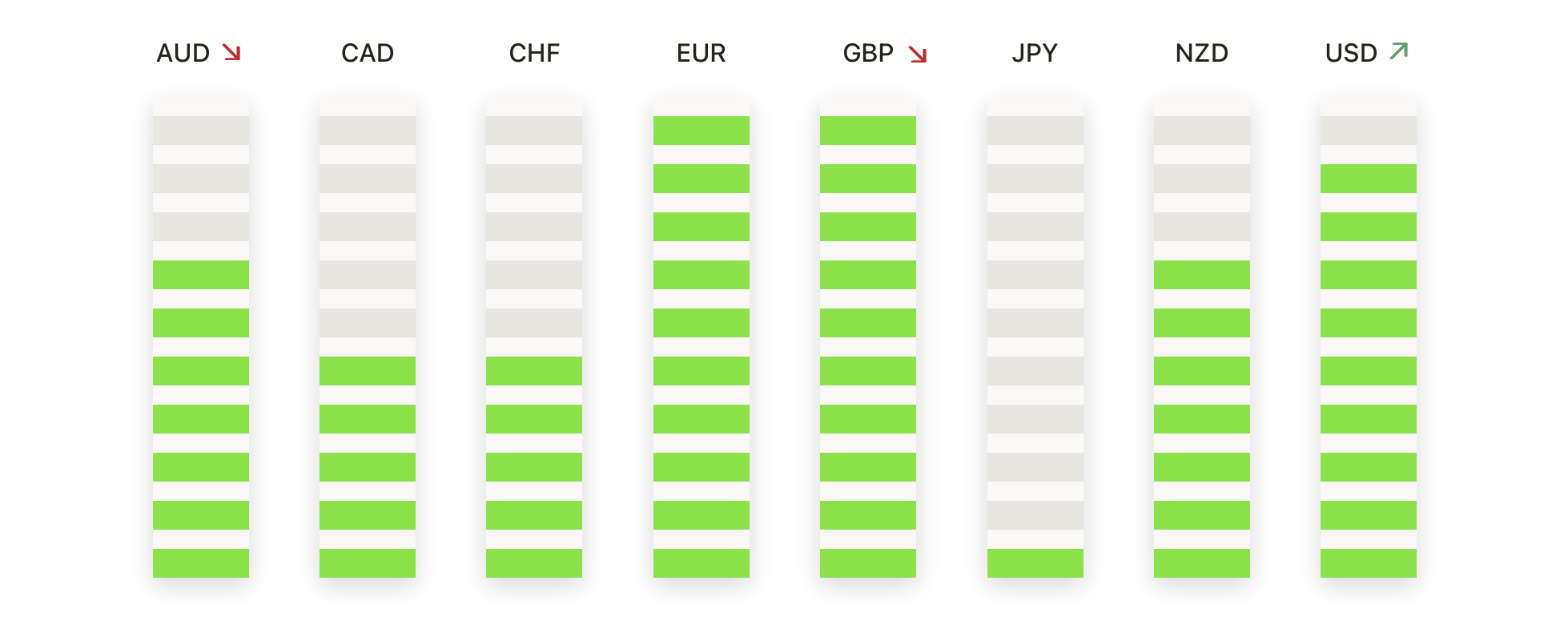

FX Today:

- EUR/USD Rebounds Amid Mixed US Data: The EUR/USD pair saw an uptick today, climbing from 1.0749 to touch a high of 1.0787. The rebound reflects mixed responses to US economic data and the anticipation of Federal Reserve’s policy direction. The currency pair is navigating near significant resistance levels, including the 50-day and 200-day simple moving averages at 1.0792 and 1.0795 respectively.

- GBP/USD Navigates Volatile Waters: The British Pound experienced volatility against the US Dollar, dipping to 1.2503, a decrease of 0.46%. As the Bank of England’s policy announcement looms, market participants are keenly observing potential shifts that could influence the pair’s trajectory, with key technical levels like the 200-day SMA at 1.2545 acting as pivotal points.

- USD/JPY Climbs Amid Rate Differential Speculations: The USD/JPY pair extended its gains, moving upwards from a recent low of 152.00 to peak at 155.00. The upward movement was influenced by the divergence in monetary policy expectations between the US and Japan, alongside intermittent interventions suspected by the Bank of Japan.

- AUD/USD Under Pressure After RBA’s Rate Decision: Following the Reserve Bank of Australia’s decision to hold rates at 4.35%, the Australian Dollar weakened against the US Dollar, dropping to 0.6589. The RBA’s cautious stance on inflation and the broader economic outlook pressured the AUD, highlighting the challenges in the currency market.

- USD/CAD Sees Breakthrough Amid Fed Rate Cut Speculation: The USD/CAD pair experienced a notable increase, breaching the 1.3700 level and peaking at 1.3705. This movement was driven by anticipations of Federal Reserve policy adjustments, influencing the CAD’s performance against the backdrop of economic data and market sentiment.

- GBP/JPY Stuck in Technical Resistance: The GBP/JPY pair faced challenges breaking past the 194.00 resistance level, fluctuating near 193.50 as it encountered resistance from the 200-hour Exponential Moving Average (EMA) just below 194.00. This pattern reflects the ongoing uncertainty and technical positioning in the market.

- Gold Reacts to US Dollar Strength and Bond Yield Movements: Gold prices experienced a downturn, declining by 0.4% to $2,315 despite the drop in US Treasury yields. The stronger US Dollar exerted pressure on gold, overshadowing the influence of falling bond yields. As market participants gauge the Fed’s next moves, the resistance at the $2,352 level remains a critical point for gold’s near-term trajectory.

Market Movers:

- Disney Faces Downward Pressure: Walt Disney shares experienced a sharp decline, dropping 9.5% after the company reported a slight miss on revenue expectations. Despite exceeding quarterly earnings estimates, the shortfall in revenue led to significant investor reactions, emphasising the stock’s sensitivity to earnings performance.

- Palantir Technologies Takes a Dive: Shares of Palantir Technologies plunged by 15.1% following the release of weaker-than-expected full-year guidance. The defence technology firm’s announcement of an anticipated annual revenue range between $2.68 billion and $2.69 billion, below market expectations of $2.71 billion, triggered a sell-off.

- Peloton Surges on Buyout Speculation: Peloton Interactive’s stock price jumped an impressive 15.5% amid rumours that private equity firms are considering a buyout of the fitness equipment and media company. The news sparked investor interest, leading to a significant uptick in trading volumes and stock value.

- Nvidia Experiences a Setback: Nvidia shares slipped by 1.7% after notable investor Stanley Druckenmiller disclosed reducing his stake in the company. His remarks about artificial intelligence being “a little overhyped” in the short term contributed to the stock’s downward movement.

- Ferrari NV Faces Headwinds: Ferrari’s US-traded shares fell by 6.2% despite the company beating Wall Street’s earnings and revenue estimates for the first quarter. The reaffirmation of previous financial guidance for the year, without any upward revision, disappointed investors looking for more aggressive growth projections.

- Datadog Sees Decline on Leadership Changes: Shares of Datadog tumbled 11.5% after announcing that President Amit Agarwal will step down at the end of the year. Although the cloud application company reported better-than-expected earnings and revenue for the first quarter, the leadership change raised concerns about future strategic directions.

- Lucid Group Drops on Wider Losses: Lucid Group’s shares declined by 14% following a reported quarterly loss wider than analyst expectations. The electric vehicle manufacturer reported a loss of 30 cents per share against the anticipated 25 cents, influencing a negative investor sentiment towards the stock.

- Rocket Lab Adjusts After Revenue Miss: Rocket Lab shares decreased by 2.2% after the aerospace manufacturer reported first-quarter revenue of $92.8 million, falling short of the FactSet consensus estimate of $95 million. Additionally, the delay in the launch of its Neutron rocket to mid-2025 further dampened investor enthusiasm.

- Hims & Hers Health Climbs on Positive Guidance: Hims & Hers Health saw its shares rise by 6% after issuing revenue guidance for the second quarter that exceeded market expectations. The telehealth platform’s optimistic outlook, projecting revenues between $292 million and $297 million, boosted investor confidence in its growth trajectory.

As the trading session concluded, the major US stock indexes displayed a mixed performance, with investors closely monitoring economic data and comments from Federal Reserve officials for clues on the central bank’s next move regarding interest rates. The Dow Jones Industrial Average and the S&P 500 inched higher, lifted by optimism surrounding potential rate cuts, while the Nasdaq Composite slipped slightly, reflecting ongoing concerns about the prospects of high-growth technology companies. Despite a challenging economic environment characterised by stubborn inflation and slowing growth, the markets exhibited resilience, with individual stocks responding to company-specific news and earnings reports.