In a significant downturn, the Nasdaq Composite recorded its sixth consecutive losing day, tumbling over 2% as Nvidia’s shares plummeted by 10%, marking a significant shift in market sentiment. This decline represents the longest losing streak for the index in over a year, increasing concerns around geopolitical strife and persistent inflationary pressures. While the broader S&P 500 also retreated, slipping below the critical 5,000 threshold, the Dow Jones Industrial Average presented a contrasting resilience, pushed by substantial gains in American Express after robust quarterly earnings.

Key Takeaways:

- Nasdaq Endures Sixth Straight Decline: The tech-heavy Nasdaq Composite fell sharply by 2.05%, marking its longest losing streak since October 2022. This week’s drop brought the index down by a notable 5.5%, underscoring its worst weekly performance since November 2022.

- S&P 500 Falls Below 5,000: Amidst broader market struggles, the S&P 500 declined by 0.88%, finishing below the 5,000 mark. It has recorded a cumulative loss of over 3% this week, indicating its steepest weekly drop since March 2023.

- Dow Jones Shows Relative Strength: Contrasting with the broader market downturn, the Dow Jones Industrial Average gained 211.02 points, or 0.56%, lifted by a 6% surge in American Express following positive earnings. This allowed the Dow to eke out a marginal weekly gain of 0.01%.

- European Stocks End Lower Amid Geopolitical Concerns: European stock markets concluded the week on a lower note, with the regional Stoxx 600 index closing down 0.1%. Despite a strong start to the year, the index is on track for its first monthly loss since October. The FTSE 100 Index fell by 1.25%, ending the week at 7895.85. Meanwhile, retail stocks in Europe dropped 0.6% following underwhelming March sales figures in the UK, which showed no growth from the previous month.

- Asia Markets Tumble Amid Risk-Off Sentiment: Taiwan’s Weighted Index suffered the most significant loss in Asia, dropping 3.81% to close at 19,527.12, marking its lowest level in over a month. This decline reflects the broader market’s reaction to escalating geopolitical tensions. Japan’s Nikkei 225 fell 2.66%, closing the week at 37,068.35, while the broader Topix index decreased by 1.91% to 2,626.32. On a weekly basis, the Nikkei shed 3.65%, indicating a cautious sentiment among investors. South Korea’s Kospi ended the day 1.63% lower at 2,591.86, and the small-cap Kosdaq closed down 1.61% at 841.91. In China, the Hang Seng index fell 0.95%, while the mainland Chinese CSI 300 slipped 0.79% to close at 3,541.66.

- Oil Prices Experience Volatility Amid Geopolitical Tensions: Oil prices saw significant fluctuations during the week, initially spiking over 3% in response to heightened tensions in the Middle East. The global benchmark Brent crude futures crossed the $90 mark before easing to just above $88. The volatility reflects the market’s nervousness about potential escalation in the region, impacting global supply channels.

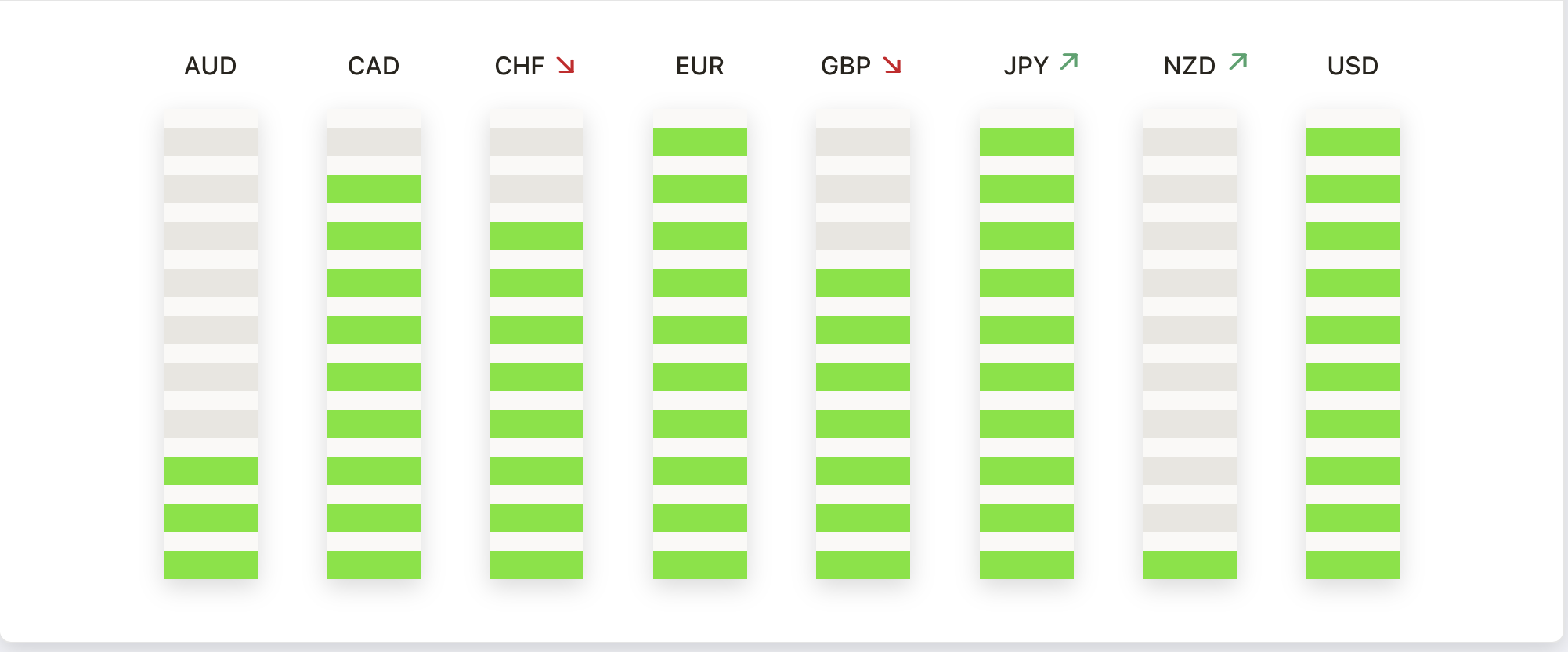

FX Today:

- EUR/USD Sees Recovery Potential: The EUR/USD pair has shown signs of recovery after enduring recent losses, climbing from the 1.0600 psychological level to above 1.0650. Resistance levels lie ahead at 1.0695 and 1.0725, with further recovery potentially pushing the pair towards 1.0820.

- USD/JPY Experiences Pullback from Highs: The USD/JPY pair reached multi-decade highs around 154.80 but has since retraced. Immediate support is anticipated around 153.20 and 152.00, with a further downward reversal potentially testing 150.80.

- GBP/USD Continues Downward Trend: GBP/USD has fallen below a key support level at 1.2430, reaching lows not seen since November. A further decline could target the Fibonacci support level at 1.2320, with a breakdown potentially extending losses towards 1.2168.

- Bitcoin Volatility Amid Halving: The Bitcoin network completed its fourth halving, reducing miner rewards to 3.125 bitcoins, down from 6.25. Despite the halving, which historically precedes significant price increases, Bitcoin’s price fell approximately 4% this week, trading around $64,100. With the price currently just under $65,000, it remains about 13% below its all-time high of $73,797.68 set on March 14.

- Gold Reaches Near Record Highs: Gold prices responded to heightened geopolitical tensions, with a spike to $2,417 this week, closely approaching its all-time high of $2,431. The metal’s price shows potential for continuation of the upward trend despite the Relative Strength Index (RSI) suggesting a possible overbought condition.

Market Movers:

- Nvidia Faces Steep Decline: Nvidia’s shares plummeted by 10%, marking its worst day since March 2020. This significant drop contributed heavily to the tech sector’s downturn and reflects investor concerns over the sustainability of growth within the artificial intelligence market.

- American Express Surges After Earnings Beat: American Express shares surged 6.2% following a strong earnings report where the company posted diluted earnings per share of $3.33, surpassing the expected $2.95. Revenue also topped estimates, coming in at $15.8 billion, compared to the anticipated $15.79 billion.

- Netflix Sinks Despite Earnings Success: Despite surpassing earnings expectations, Netflix shares fell more than 9%. The company announced it would cease reporting subscriber growth from 2025, which raised concerns about future transparency and growth metrics.

- Super Micro Computer Tumbles: Shares of Super Micro Computer saw a dramatic fall of more than 23%. This decline came ahead of its fiscal third-quarter results, which are set to be released on April 30, with the company providing no guidance ahead of the report.

- SLB Reports Mixed Results: SLB (formerly Schlumberger) reported a 2.18% drop in its share price despite meeting first-quarter revenue and earnings expectations. The decline was primarily due to a year-over-year drop in North American revenue, signalling potential regional challenges.

- Ulta Beauty Downgraded, Shares Fall: Ulta Beauty’s shares declined by 3% after an analyst downgrade from Jefferies, which moved the rating from ‘buy’ to ‘hold’ due to increasing competition in the beauty retail sector.

- Shopify Climbs on Upgrade: Shopify’s stock edged up by 0.27% after Morgan Stanley upgraded the e-commerce firm to ‘overweight’ from ‘equal weight’. The upgrade was based on confidence in Shopify’s growth potential and operational leverage.

- Ibotta Declines After IPO: Following its initial public offering, shares of Ibotta dropped 6.17%, although they remain approximately 11% above the IPO pricing. This movement reflects the volatile nature of newly public companies as they find their footing in the market.

- Paramount Rises on Acquisition Talks: Paramount shares increased more than 13% amid reports that Sony Pictures Entertainment and Apollo Global Management are discussing a potential joint acquisition of the media giant.

- PPG Industries Misses Revenue Forecasts: PPG Industries experienced a 3% drop in share price after missing revenue expectations for the first quarter due to falling sales volumes, reflecting broader challenges in the materials sector.

The market session was marked by great volatility, as the Nasdaq’s extended sell-off, amplified by losses in tech heavyweights like Nvidia, had effects across broader indices. The escalating geopolitical tensions between Israel and Iran, coupled with persistent inflation concerns, further unsettled investors, nudging investors to safe-haven assets like gold. Despite some sectors showing resilience, such as the Dow Jones buoyed by American Express’ earnings, the overall market mood remains wary. As the dust settles on this turbulent week, market participants brace for the impact of these developments on the global financial landscape.