The stock market showcased a remarkable upswing, driven by a number of strong corporate earnings that eased concerns over impending interest rate hikes. The Dow Jones Industrial Average and the S&P 500 posted significant gains, lifted by investor optimism. Leading the charge, notable companies like Spotify and UPS delivered earnings that exceeded expectations, boosting confidence across the board. This surge comes as a continuation of positive momentum, setting an optimistic tone as the market gears up for more earnings reports from major tech firms later this week.

Key Takeaways:

- Dow Jones Advances Amid Optimism: The Dow Jones Industrial Average capitalised on the upbeat market sentiment, climbing 263.90 points, or 0.69%, signalling investor confidence boosted by strong earnings reports across various sectors.

- S&P 500 Hits a 1.2% Gain: The S&P 500’s rise by 1.2% underscores a broad market strength as 76% of the companies reporting so far have exceeded analysts’ expectations according to FactSet data, enhancing investor optimism in the robustness of corporate America.

- Nasdaq Composite Leads with Tech Surge: The Nasdaq Composite outpaced its peers with a 1.59% increase, driven by significant gains in technology stocks like Spotify, which surged 11% following better-than-expected earnings and optimistic future guidance.

- European Markets Close Higher Amid Optimistic Data: European stock markets ended the day on a strong note, with significant gains across major indices. The UK’s FTSE 100 not only reached a new intraday record high of 8067.73 but also closed at 8044.81, marking consecutive record-setting days. Germany’s DAX led major European bourses with a substantial rise, gaining 1.6% to close higher, while France’s CAC 40 advanced by 0.8%. The pan-European Stoxx 600 index also saw a positive close, increasing by 1.1%, driven by investor optimism following strong business activity data across the eurozone and potential signals for upcoming interest rate cuts.

- Asian Markets Show Mixed Responses with Notable Gains and Losses: The Asia-Pacific markets displayed a varied performance. Hong Kong’s Hang Seng index led the region with a strong gain, climbing almost 2% to close significantly higher. In contrast, mainland China’s CSI 300 index faced a downtrend, declining by 0.7% to 3,506.22, marking its third consecutive day of losses. Japan’s Nikkei 225 experienced modest growth, rising 0.3% to end at 37,552.16, while the broader Topix index edged up by 0.14% to 2,666.23. Australia’s S&P/ASX 200 also saw positive movement, advancing 0.45% to close at 7,683.5. Meanwhile, South Korea’s Kospi slightly declined by 0.24% to 2,623.02, and the smaller cap Kosdaq dropped by 0.04% to finish at 845.44.

- Treasury Yields Decline Amid Economic Data: US Treasury yields saw a decline, with the benchmark 10-year Treasury note dropping 3.5 basis points to 4.588%, following a weaker-than-expected US manufacturing PMI, which could signal a slower pace of interest rate hikes.

- US Oil Prices Rally Amid Economic Speculation: US crude oil prices advanced nearly 2%, reaching $83.36 a barrel, fuelled by speculation that a slowdown in manufacturing could prompt the Federal Reserve to cut interest rates sooner than anticipated. This optimism stemmed from the latest S&P Global Flash US Composite PMI indicating a contraction in manufacturing activity with a reading of 49.9. Meanwhile, Brent crude also rose to $88.42 a barrel, reflecting similar market dynamics.

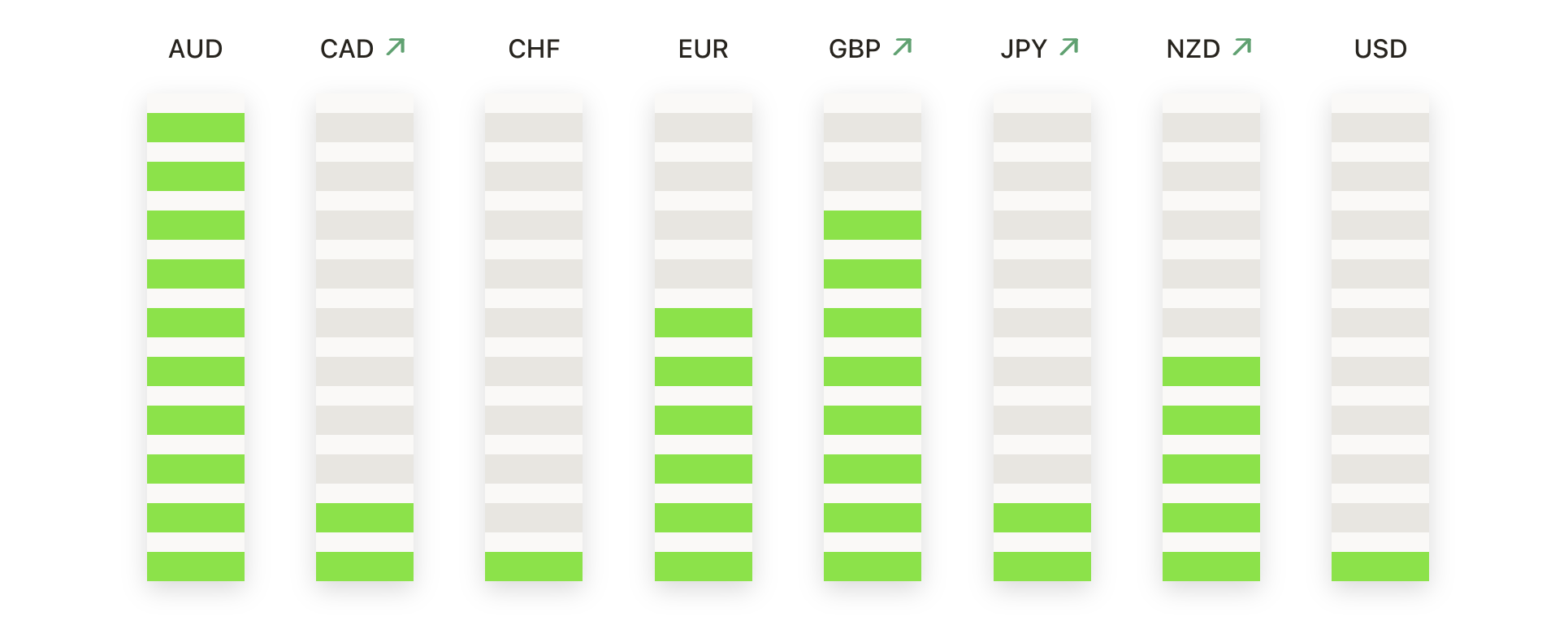

FX Today:

- EUR/USD Gains Momentum Amid Dollar Weakness: The EUR/USD pair climbed to a one-week high, closing up 0.47% at just above the 1.0700 level. This surge was boosted by favourable Eurozone economic data, with the April S&P Composite PMI unexpectedly rising to an 11-month peak. Technical analysis suggests that if the EUR/USD can sustain a close above 1.0700, it may target the 1.0800 zone, bounded by the 50 and 200-day moving averages at 1.0806 and 1.0811, respectively.

- GBP/USD Eyes Key Resistance Amid Bullish Signals: The GBP/USD found support as a potential ‘morning star’ chart pattern emerged around the 1.2440 level. If this pattern holds, the next resistances are the 1.2500 mark, followed by the 200-day moving average at 1.2565. Further resistance lies at the 50-DMA at 1.2628 and the 100-DMA at 1.2649. A break below 1.2400 could threaten to revisit the year-to-date low of 1.2299.

- USD/JPY Rebounds from 33-Year Low: The USD/JPY pair slightly recovered from its lowest in 33 years, down just 0.03% for the day. The yen benefited from the Japanese Finance Minister’s hints at potential market interventions and was further supported by a rise in Japan’s April Jibun Bank manufacturing PMI to an 11-month high.

- USD/CAD Under Pressure from Soft Dollar: The USD/CAD dipped below the 1.3700 threshold, reaching an intraday low near 1.3660. It’s approaching a critical support zone around 1.3600. Should the dollar regain strength, resistance at the last swing high near 1.3850 may come into play, with major support set at the 200-day Exponential Moving Average just above the 1.3500 mark.

- Gold Struggles for Direction Amid Volatile Trade: Gold prices (XAU/USD) initially dropped to a two-week low of $2,291 before recovering above $2,300. For the upward trend to continue, buyers need to propel the metal above the $2,350 mark to challenge further highs. Conversely, a drop below the daily low of $2,324 might push prices towards the $2,300 support level and potentially test the $2,222 high seen on March 21.

Market Movers:

- Tesla Surges on New Model Announcements and Earnings Outlook: Tesla’s shares surged over 11% in after-hours trading following the announcement of plans to introduce new, more affordable models ahead of their initial schedule. The company’s stock jump followed its report of first-quarter revenue of $21.3 billion, down from $23.33 billion the previous year but closely watched by investors who had anticipated around $22.15 billion. Despite these challenges, Tesla’s proactive strategy in releasing new models before the second half of 2025 demonstrates its commitment to maintaining a competitive edge in the evolving electric vehicle market.

- General Motors Accelerates on Strong Earnings: General Motors shares ascended more than 4% after the company reported first-quarter earnings that surpassed analysts’ expectations. The automaker posted adjusted earnings of $2.62 per share on revenue of $43.01 billion, significantly higher than the forecasted $2.15 per share and $41.92 billion in revenue. Additionally, General Motors boosted its forecast for adjusted automotive free cash flow to between $8.5 billion and $10.5 billion, exceeding previous estimates.

- Spotify Hits High Note with Earnings Beat: Spotify’s stock soared 11% after the streaming giant outperformed earnings expectations, reporting a robust 97 euro cents per share for the first quarter, well above the anticipated 65 euro cents. The company also surpassed quarterly gross margin forecasts, signalling a strong start to the year.

- GE Aerospace Lifts Off on Earnings Surprise: Shares of GE Aerospace climbed 8% following a report of first-quarter adjusted earnings of 82 cents per share, which beat the consensus estimate of 65 cents per share. The company’s revenue of $16.1 billion also topped expectations, showcasing its continued growth in the aerospace sector.

- PepsiCo’s Mixed Results Lead to Dip: Despite beating earnings expectations with $1.61 in adjusted earnings per share against the anticipated $1.52, PepsiCo’s shares declined by 3%. The company maintained its full-year outlook, which may have tempered enthusiasm following the earnings beat.

- JetBlue Airways Descends on Forecast Cut: JetBlue Airways’ shares plummeted 19% after the airline revised its second-quarter and full-year 2024 revenue forecasts downward. Although the first-quarter revenue met expectations, the adjusted loss per share was narrower than expected, concerns about future profitability weighed heavily on investor sentiment.

- Cleveland-Cliffs Faces Downward Pressure: Cleveland-Cliffs saw its shares tumble 11% after the steel producer missed first-quarter earnings and revenue expectations. The company reported adjusted earnings of 18 cents per share on $5.2 billion in revenue, falling short of the projected 22 cents per share on $5.35 billion, raising concerns about future performance.

- Nucor Stumbles After Earnings Miss: Shares of Nucor dropped 9% following a disappointing earnings report for the first quarter. The steelmaker’s earnings and revenue fell below estimates, and the company predicted lower second-quarter earnings due to decreasing average selling prices, only partially offset by modest volume increases.

- Danaher Excels with Strong Quarterly Performance: Danaher’s stock surged 7% after the company exceeded analysts’ expectations for the first quarter, reporting adjusted earnings of $1.92 per share on revenue of $5.8 billion. This performance outstripped the anticipated $1.72 per share on $5.62 billion, highlighting its robust position in the life sciences industry.

As we move deeper into April, the strong performance of key indices like the Dow, S&P 500, and Nasdaq underscores the market’s optimistic response to robust corporate earnings and favourable economic indicators. The overwhelming majority of S&P 500 companies beating earnings expectations has boosted investor confidence, easing concerns over potential rate hikes and inflationary pressures. Moreover, the anticipation of upcoming earnings reports from tech giants adds a critical dimension to market dynamics. Additionally, significant movements in the FX and commodities markets continue to influence investor strategies, highlighting the intricate interconnections between global economic signals and market behaviour. This complex array of factors offers both challenges and opportunities, guiding investor actions in a landscape marked by both caution and potential.