The US stock market experienced a tug-of-war on Thursday, with the Dow Jones Industrial Average making a modest gain while the S&P 500 and Nasdaq Composite fell to selling pressure. Investors grappled with the conflicting forces of a resilient economy and the Federal Reserve’s hawkish stance on inflation, leading to a mixed performance across major indices. Meanwhile, gold prices surged as escalating tensions in the Middle East increased safe-haven demand, adding to the complex landscape of economic and geopolitical crosswinds shaping market sentiment.

Key Takeaways:

- S&P 500 Suffers Prolonged Decline: The S&P 500 closed down by 0.3%, marking its fifth consecutive day of losses, the longest such streak since October of last year. This ongoing decline highlights the index’s vulnerability in the current economic climate, with a cumulative weekly drop exceeding 2%.

- Nasdaq Faces Continued Pressure: The Nasdaq Composite recorded a sharper decline of 0.6%, influenced heavily by struggles within the tech sector. The index is now poised for its fourth consecutive week of losses, its longest negative run since December 2022, emphasizing the impact of broader market uncertainties on technology stocks.

- Dow Jones Shows Relative Stability: Contrasting with its counterparts, the Dow Jones Industrial Average saw a modest increase of 58 points, or 0.1%, maintaining a near-flat performance throughout 2024. This suggests a restrained optimism among investors favouring blue-chip stocks amid broader market fluctuations.

- European Markets Edge Higher Amid Speculation: European markets closed slightly higher with the Stoxx 600 index up by 0.3%. Sector performance was mixed, with banks gaining 1.6% while oil and gas stocks fell by 1.46%. FTSE 100 Index ends 0.37% higher at 7877.05. Speculation about an upcoming rate cut by the European Central Bank encouraged modest optimism among investors.

- Asian Markets Rebound Contrasting US Declines: The Nikkei 225 in Japan reversed its earlier losses, closing up by 0.31% at 38,079, breaking a three-day losing streak. Similarly, South Korea’s Kospi led the gains across Asian markets, advancing 1.95% to settle at 2,634.7. The broader Topix index in Japan also saw an uplift, rising 0.54% to 2,677.45. In China, the Hang Seng index climbed by 1%, and the CSI 300 index edged up by 0.12%, closing at 3,569.8. These movements reflect a robust regional response to global economic tensions.

- Oil Prices React to Market Dynamics: Crude oil futures were mixed on Thursday, with West Texas Intermediate (WTI) for May delivery slightly increasing by 4 cents to settle at $82.73 a barrel. In contrast, June Brent futures saw a decrease, losing 18 cents to settle at $87.11 a barrel. This pricing behaviour followed a significant sell-off earlier in the week, which was influenced by reduced fears of an immediate escalation in Middle Eastern hostilities, particularly between Israel and Iran, potentially disrupting oil supplies.

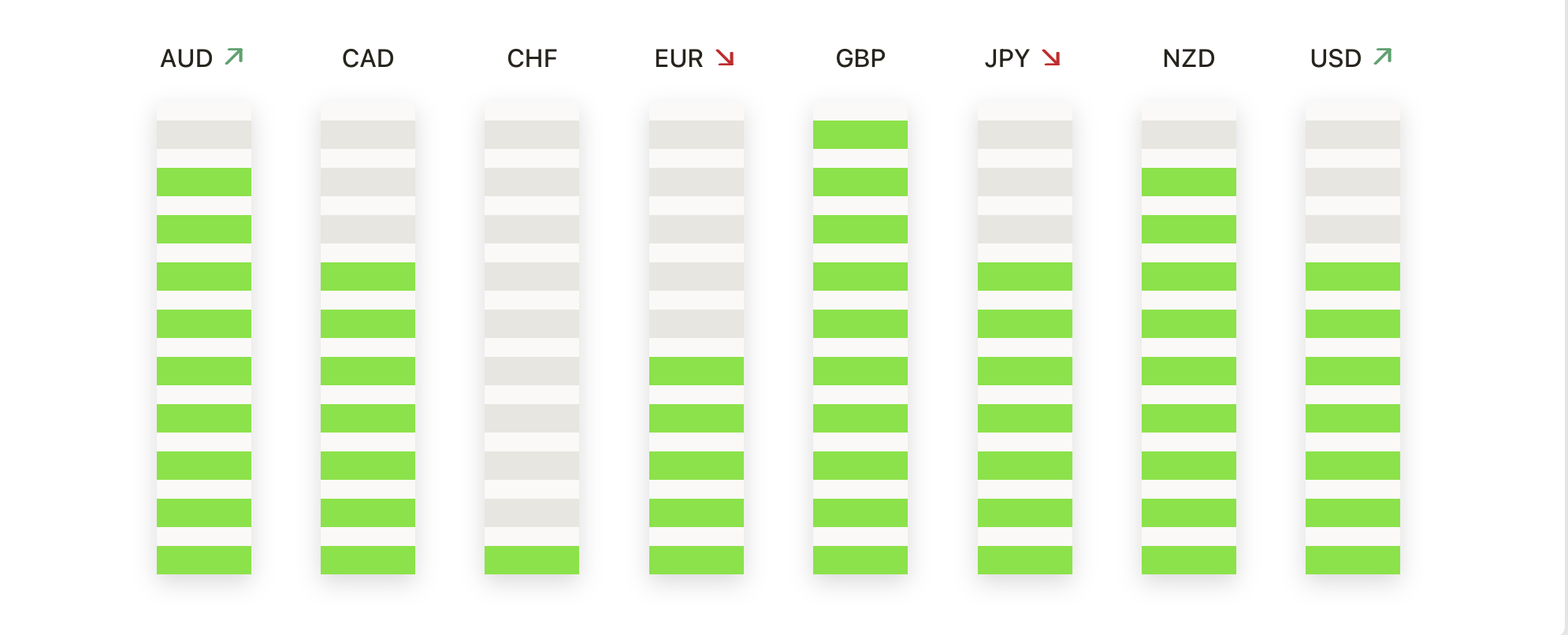

FX Today:

- Gold’s Safe-Haven Demand Surges Amid Geopolitical Tensions: Amid escalating tensions in the Middle East, spot gold prices saw a significant increase, gaining 0.9% to reach $2,382.09 per ounce, with a recent high of $2,431.29. The rising uncertainty has strengthened gold’s appeal as a safe-haven asset, driving prices higher despite strong US economic data that might typically cause trouble to gold’s rise. The market’s sentiment remains bullishly biased, suggesting a potential continuation of the uptrend, especially if geopolitical tensions persist.

- EUR/JPY Experiences Mild Downturn Yet Maintains Bullish Outlook: The EUR/JPY pair faced a slight decline, dropping to 164.70, but the overall market trend continues to favour the bulls. A consolidation phase is anticipated as the pair navigates below the middle zone on the RSI, indicating a possible balance in buying and selling pressures. The pair remains well-supported by its 20, 100, and 200-day SMAs, indicating an underlying bullish sentiment that may prevail barring significant market shifts.

- US Dollar Strengthens on Hawkish Federal Reserve and Yield Recovery: The US Dollar Index (DXY) showed upward momentum, advancing towards 106.25 with potential to test higher levels around 107.10. This rise is supported by a hawkish stance from the Federal Reserve and a rebound in US Treasury yields, which reinforces the dollar’s strength. The bullish outlook is further underscored by positive indicators, suggesting continued investor confidence in the dollar.

- Canadian Dollar Fluctuates Amid Yield Spread Challenges: The Canadian dollar closing nearly unchanged at 1.3765, which equates to 72.65 US cents. Throughout the day, the loonie fluctuated within a narrow range from 1.3743 to 1.3781. This stability comes despite the currency facing downward pressure earlier in the week, when it reached a five-month low of 1.3846.

Market Movers:

- Tesla Slides After Downgrade: Tesla’s shares were down more than 3% leading losses in the Nasdaq 100 after Deutsche Bank downgraded the stock from buy to hold, indicating potential concerns about the company’s near-term growth prospects.

- Las Vegas Sands Faces Setback Despite Earnings Beat: Las Vegas Sands closed down more than 8%, leading the losers in the S&P 500, despite reporting Q1 earnings per share above expectations. The significant decline was primarily due to disappointing results from its operations in Macau, which missed consensus estimates.

- Equifax Drops on Revenue Miss and Lower Forecast: Equifax’s shares fell more than 8% after the company reported Q1 operating revenue of $1.39 billion, which was weaker than the consensus of $1.41 billion. Additionally, the company’s forecast for full-year revenue ranged from $5.67 billion to $5.77 billion, below the expected $5.80 billion, adding to investor concerns.

- Snap-on Struggles with Sales Miss: Shares of Snap-on Inc closed down more than 7% following a Q1 net sales report of $1.18 billion, below the consensus estimate of $1.20 billion. The drop reflects the market’s reaction to the company’s performance shortfall.

- Chip Sector Under Pressure, Leading Tech Declines: The chip sector continued to experience pressure, contributing to broader tech sector losses. Notable declines included Micron Technology and NXP Semiconductors, each down more than 3%, while ON Semiconductor, Applied Materials, and Lam Research fell over 2%. Other key players like ASML Holding, KLA Corp, Marvel Technology, Qualcomm, and Texas Instruments also saw declines exceeding -1%.

- Autodesk Declines on Reporting Delay: Autodesk’s stock fell 2%, adding to a 5% drop from the previous day, after the company announced delays in filing its annual report due to ongoing investigations into its cash flow and non-GAAP operating margin practices. This uncertainty contributed to the negative investor sentiment.

- Genuine Parts Co Leads Gainers on Earnings Surprise: Genuine Parts Co topped the S&P 500 gainers, with shares climbing over 11% after reporting a Q1 adjusted EPS of $2.22, surpassing the consensus estimate of $2.17. The company also raised its full-year EPS forecast to $9.80-$9.95, above the expected $9.78, signalling strong future performance.

- Elevance Health Climbs on Raised Forecast: Elevance Health’s stock increased more than 3% after the company reported Q1 adjusted EPS of $10.64, beating the forecast of $10.53. Furthermore, it raised its full-year adjusted EPS forecast to above $37.20, exceeding the consensus of $37.16, increasing investor confidence.

- Discover Financial Services Rises on Strong Interest Income: Discover Financial Services saw its shares rise more than 3% after reporting Q1 net interest income of $3.49 billion, topping the consensus estimate of $3.40 billion. This performance highlights the company’s robust revenue generation capabilities amid challenging economic conditions.

- Netflix Surges on Strong Subscriber Growth and Earnings Beat: Netflix shares rose significantly after the streaming giant reported a substantial increase in subscribers and surpassed earnings expectations. Total memberships rose 16% in the quarter, reaching 269.6 million. Despite the positive earnings report, Netflix shares fell 3.5% after hours.

As April unfolds, the continued downward trajectory of major indices like the S&P 500 and Nasdaq highlights an atmosphere of caution among investors. Despite this, the resilience shown by sectors such as health and finance, evidenced by strong performances from companies like Elevance Health and Discover Financial Services, suggests pockets of optimism. The shifting dynamics underscore a market grappling with mixed economic signals, where investor sentiment remains fragile amid concerns over inflation and interest rate policies.