Stocks staged a comeback on Thursday, with the S&P 500 and the Nasdaq Composite gaining, as technology shares led the market higher despite lingering worries over persistent inflation. The Dow Jones Industrial Average added 68 points, rounding out a mixed session that saw investors shrug off concerns from a hotter-than-expected consumer price index (CPI) reading the previous day. Amid this turbulence, Apple and Nvidia stood out, posting significant gains and giving investors a sense of hope. The market’s resilience highlighted the ongoing war between optimism surrounding tech advancements and concern over the Federal Reserve’s ability to tame stubbornly high inflation.

Key Takeaways:

- S&P 500, Nasdaq Composite Surge and Dow Jones Shows Modest Increase: The S&P 500 climbed by 0.9% to offset recent losses, while the Nasdaq Composite increased by 1.7%, signalling a strong recovery in tech stocks after a period of inflation-related volatility. The Dow Jones Industrial Average experienced a modest uptick, adding 68 points or 0.2%, though it is projected to close the week nearly 1% lower.

- European Central Bank Signals Potential Rate Cuts Amid Static Interest Rates: The European markets reacted to the European Central Bank’s (ECB) latest policy decision, with the Stoxx 600 index closing down by 0.4%. The ECB maintained interest rates steady but strengthened its language regarding potential future cuts. The FTSE 100 Index decreased by 0.47% to 7,923.80, reflecting broader concerns in European financial markets. The banking sector felt the most significant impact, tumbling by 2.4% as investors recalibrated their expectations in light of the ECB’s stance and the persistent inflationary pressures in Europe.

- Asian Markets Deteriorate During US Inflation Concerns: In Asia, markets largely trended downward, influenced by the unsettling inflation data from the US and internal political dynamics. China’s consumer inflation decelerated while the Hang Seng index in Hong Kong declined by 0.25%, while the CSI 300 index of mainland China also saw a marginal drop, ending at 3,504.24. The Kospi in South Korea showed resilience, closing nearly flat, whereas Japan’s Nikkei 225 index dropped by 0.35%.

- Oil Prices Recede as Inflation Fears Temporarily Eclipse Geopolitical Risks: US crude oil futures took a notable downturn, with the West Texas Intermediate for May delivery falling $1.19 or 1.38%, to settle at $85.02 a barrel. Similarly, Brent futures for June delivery decreased by 74 cents or 0.82%, closing at $89.74 a barrel. Despite the previous session’s gains, sparked by the prospect of an Iranian strike against Israel, oil prices adjusted as the anticipated conflict has not materialised, with the market’s week-to-date performance showing a decline of approximately 1.8% for US crude and 1.4% for Brent crude.

- Inflation Data Induces Market Volatility: Recent US inflation reports revealed a 3.5% year-on-year increase, exceeding expectations and fuelling concerns over persistent inflationary pressures, influencing Federal Reserve rate expectations.

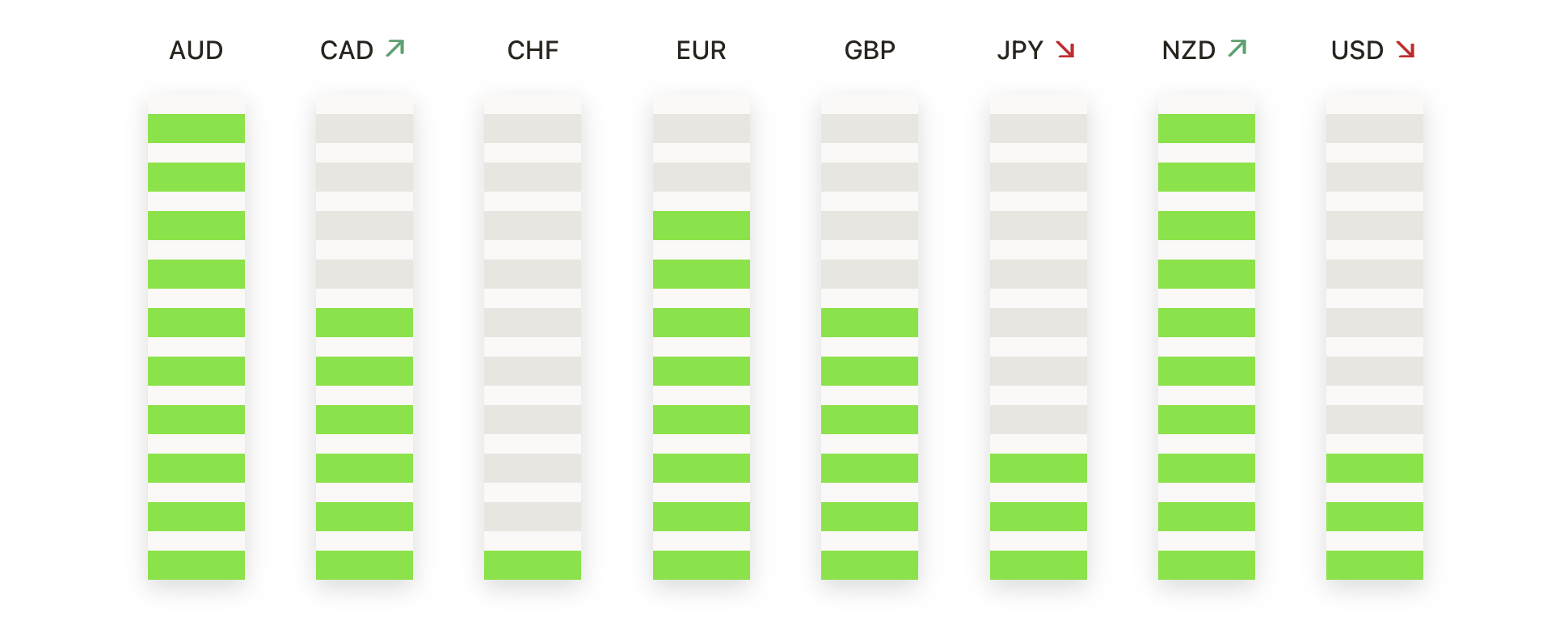

FX Today:

- US Dollar Ascends Amid Inflation Data: The US Dollar showcased strength, breaking past the two-month channel top and rallying towards 1.3700. This ascent reflects the market’s reaction to the US inflation figures, which have reduced expectations for an immediate Federal Reserve rate cut, reinforcing the dollar’s bullish trend.

- Euro Under Pressure After ECB Announcement: The Euro faced a downturn, touching an 8-week low, as the European Central Bank signalled potential rate cuts if inflation continues to decline. The EUR/USD pair ended the day down by 0.15%, reflecting the market’s cautious stance on the euro zone’s economic outlook.

- Japanese Yen Hits 33-Year Low Against Dollar: The USD/JPY pair edged up by 0.05%, as the yen fell to a 33-year bottom versus the dollar. Despite Japan’s currency weakening, speculation of potential market intervention by Japanese authorities to support the yen adds a layer of complexity to the currency’s trajectory.

- Canadian Dollar Struggles for Direction: The US Dollar broke above the channel top against the Canadian Dollar, trading near 1.3700 as strong US inflation data dampened hopes of a near-term rate cut. The currency’s movements against the dollar highlight the intricate dance between domestic economic indicators and broader global financial trends.

- Swiss Franc Sees Modest Retreat: The USD/CHF pair experienced a slight pullback from year-to-date highs, dropping below 0.9100. Despite this, the pair remains supported by a broader uptrend in the dollar, with immediate resistance observed at the 0.9100 mark and subsequent levels awaiting at 0.9147 and 0.9200.

- Gold Price Rallies Amid Inflation and Yield Dynamics: Gold prices climbed despite overarching inflation concerns, with the metal close to all-time high levels. The precious metal’s price saw a significant uptick, moving towards the $2,365 area, as lower US real yields bolstered its appeal as a safe-haven asset, with a potential to challenge the psychological $2,400 mark if current trends persist.

Market Movers:

- Apple Illuminates the Dow with AI Ambitions: Apple led the Dow Jones surge, ascending more than 4% after revealing plans to revolutionize its Mac line with new in-house processors, emphasizing artificial intelligence capabilities and fuelling investor enthusiasm.

- Nvidia and Chip Sector Heat Up: Nvidia, alongside its semiconductor peers, experienced a notable rally with a nearly 4% jump. The broader chip sector, including Broadcom and Micron Technology, also gained traction, reflecting strong market demand and bullish sentiment on tech advancements.

- Atlassian Leaps on Upgrade and Positive Outlook: Atlassian topped the Nasdaq 100 gainers, surging more than 4% after an upgrade by Barclays to overweight, setting a target price of $275, underscoring confidence in its market position and future growth prospects.

- Paramount Global Climbs on Divestiture News: Shares of Paramount Global increased over 7% following reports of its potential sale of the VidCon unit, indicating strategic moves that resonate positively with investors.

- CarMax Dips on Earnings Disappointment: CarMax experienced a significant drop, plunging more than 9%, as its quarterly financial results fell short of market expectations, highlighting the challenges in the auto retail sector.

- Aviva Faces Downturn on Rebranding Strategy: British insurer Aviva saw its shares decline by 6% amidst announcements of restructuring its financial lines business, prompting investor scepticism about its strategic direction.

- Fastenal and Gen Digital Face Headwinds: Fastenal and Gen Digital were among the notable losers, with Fastenal’s shares dipping more than 6% following underwhelming sales figures, and Gen Digital falling similarly after a downgrade, reflecting investor concerns over their performance and market prospects.

- Pharmaceutical Firms in the Spotlight: Alpine Immune Sciences skyrocketed over 37% following acquisition news by Vertex Pharmaceuticals, while Janux Therapeutics gained over 12% amid potential sale discussions, showcasing the dynamic and speculative nature of the pharmaceutical sector.

Thursday’s trading session saw a remarkable rebound in US stocks, led by a surge in technology shares that defied concerns over persistent inflation. While economic data releases, such as the PPI reading, provided some relief, the market’s resilience highlighted the ongoing tug-of-war between optimism surrounding tech and AI advancements and worry over the Federal Reserve’s ability to tame stubbornly high inflation. As investors navigated this delicate balance, currency and commodity markets reflected the evolving sentiment, with the US dollar and gold attracting safe-haven flows amid the uncertainty.