INFINOX Trading

Unlock trading opportunities in more than 900 financial markets with INFINOX. Sign up today to get started.

Please note that you are entering the site for INFINOX Limited in Mauritius, who is regulated by The Financial Services Commission of Mauritius.

By clicking Continue, you acknowledge the information below.

You confirm that you wish to continue to open an account with INFINOX Limited in Mauritius, who is regulated by The Financial Services Commission of Mauritius.

By clicking continue, you acknowledge that you will not receive the protections that you would normally be afforded under EU regulation.

This website does not provide services to UK Clients.

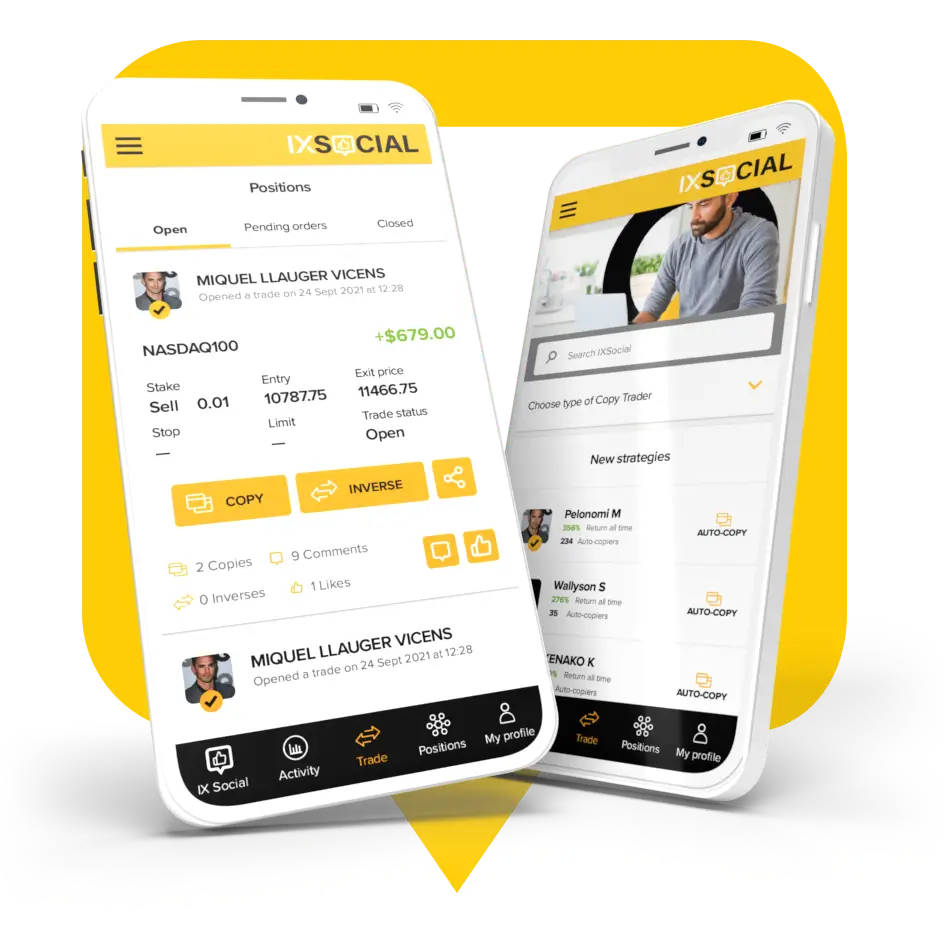

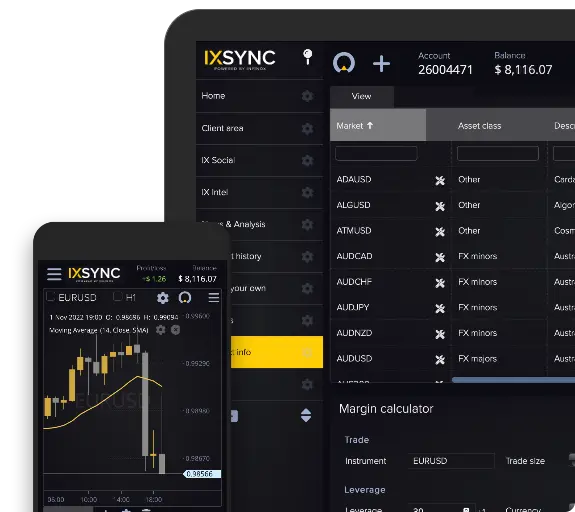

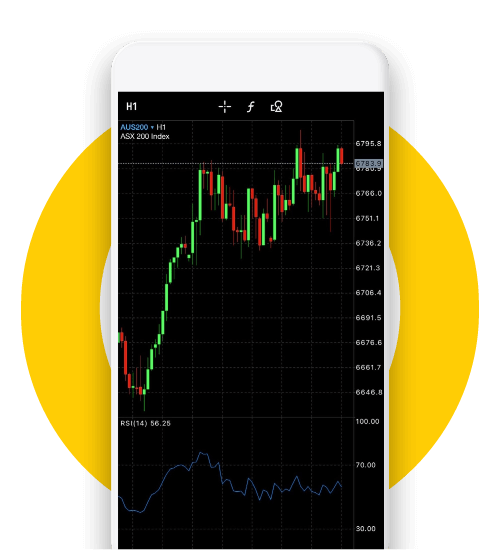

Trade smarter with IX Social, our premier copy-trading platform, letting you follow seasoned traders effortlessly. For a broader trading experience, explore IX SYNC or tap into the trusted MT4 and MT5 platforms

IX Social

IX SYNC

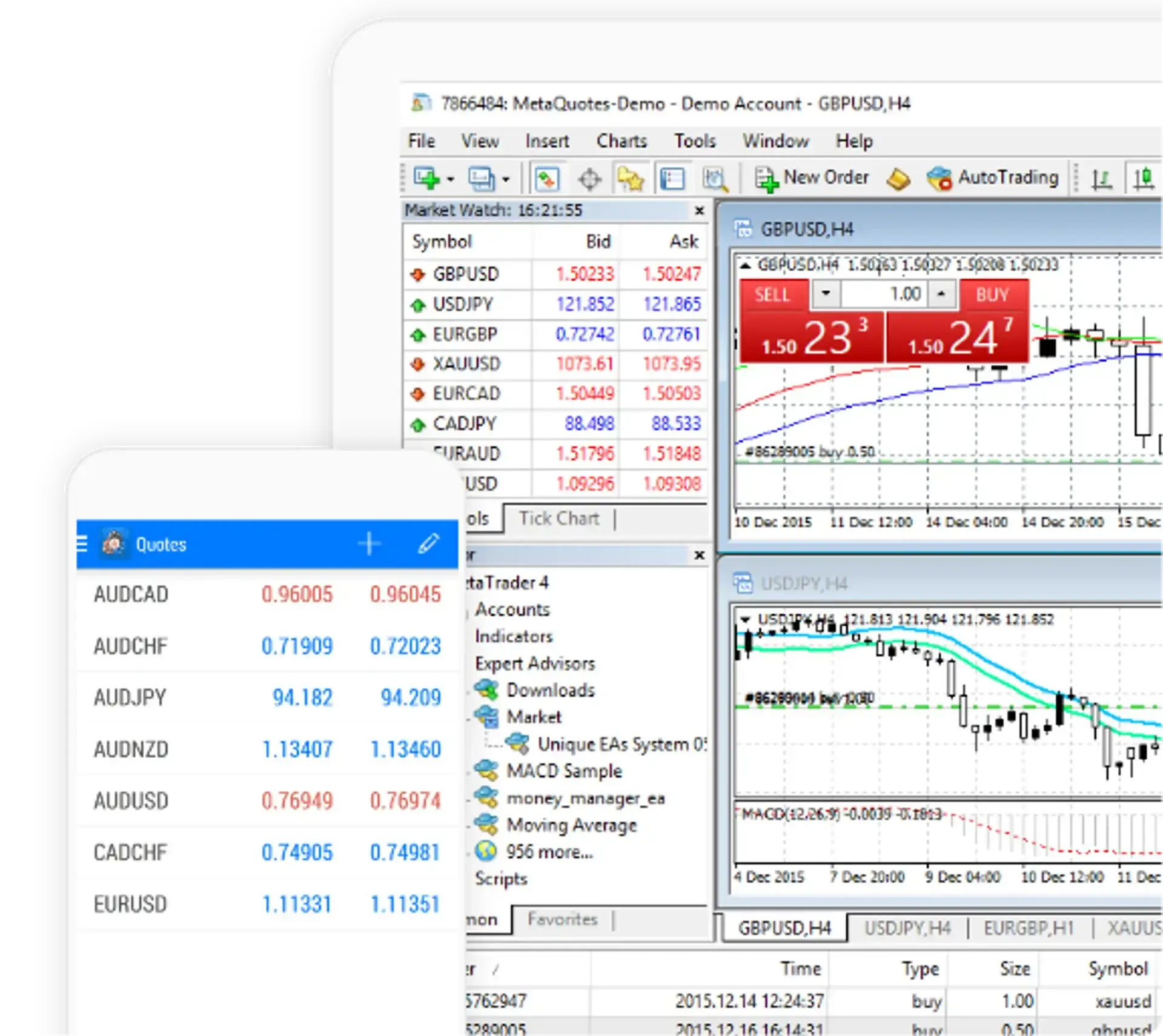

Metatrader 4

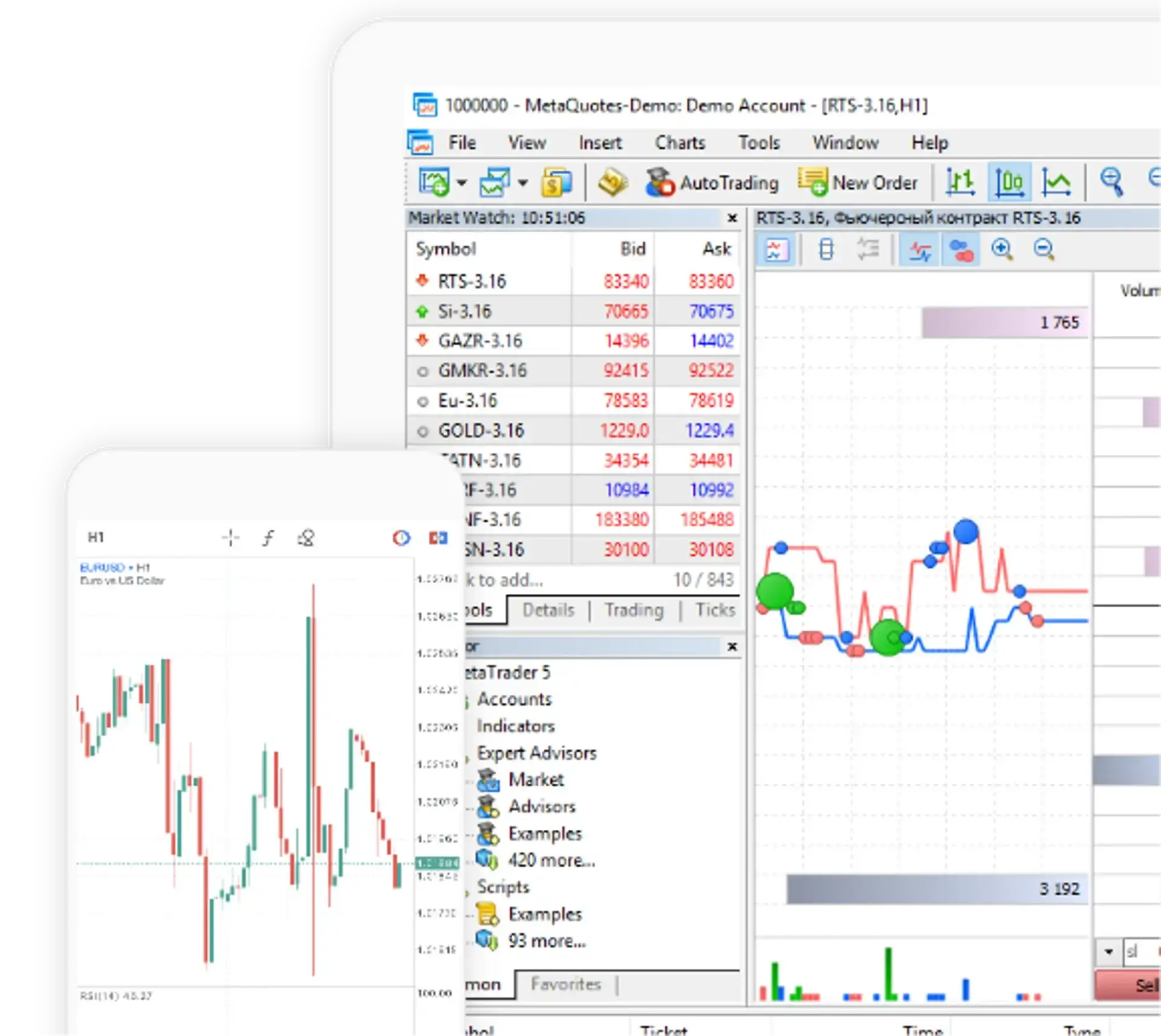

Metatrader 5

Trade anytime, anywhere with the IX Social mobile app. Auto-copy from a selection of top global traders, and earn the same results they do. It’s as easy as choose - follow - copy. Once your IX Social account is set to automatically copy your chosen traders, leave it running while you go about your day.

Auto-copy feature

Risk management

Live track records

Discussion boards

Integrated client area for faster deposits & withdrawals

Multiple charting options & 120+ technical indicators

Live & pre-market video insights from multi-lingual analysts

40+ widgets - economic calendar, pip calculator, currency heat maps & more!

Trade a range of assets on the MT4 trading platform. Access extensive charting options, technical analysis tools, algo trading through Expert Advisors and more. MetaTrader 4 is an online trading platform developed by MetaQuotes Software. It has been a popular software of choice for retail traders since its release in 2005.

EA compatibility

Trade on the go with mobile and tablet

4 execution order options

30 technical indicators

Trade on the advanced MT5 platform. Access algorithmic trading, technical and fundamental analysis tools, flexible order options, extensive price analysis functions, trading signals and more. MT5 is the next-generation version of the popular MetaTrader 4 platform, developed by MetaQuotes Software.

6 execution order options

12 additional time frames

Advanced charting software

38 technical indicators

Access 900+ instruments spanning forex, equities (CFD), indices, commodities, bonds, futures (CFD), and crypto (CFD) – all at your fingertips, every trading day.

Access real-time data and track your favorite instruments with INFINOX.

Make informed trading decisions by monitoring price changes, market indicators, charts, and more.

Real-time market prices

| Markets | Sell | Buy |

|---|

Popular

Commodities

Crypto

Forex

Futures

Indices

Search instruments

Prices displayed are indicative only and should not be considered as accurate information when trading the financial markets.

Multi-Regulated Broker

Multilingual Customer Support

Range of Trading Tools

Education and Research Insights

Foundations: Established in 2009, INFINOX has been more than just a trading platform. We’re your dedicated trading partner, anchored by principles of integrity and ambition.

Global Compliance: Our commitment shines through our stringent regulatory oversight. Licensed in key global regions, we’re a name you can trust.

Client Security: Your funds are safely held in segregated accounts. Enhanced with insurance protection, safeguarding deposits up to $500,000.

Dive deep into a curated collection of market analysis, research, and educational pieces tailored for today's trader. Whether you're a beginner or a seasoned investor, there's always something new to discover. Propel your trading knowledge to the next level.

Apply online, quick & simple registration

Send us proof of identity and/or address for verification *Required for trading

Make your deposit easily, quickly and securely to start placing orders

Enjoy over 900 instruments to trade through INFINOX